Optimal Entry Points With a Morning Star

In this article, we'll discuss the different options for entry points after the appearance of a morning star pattern.

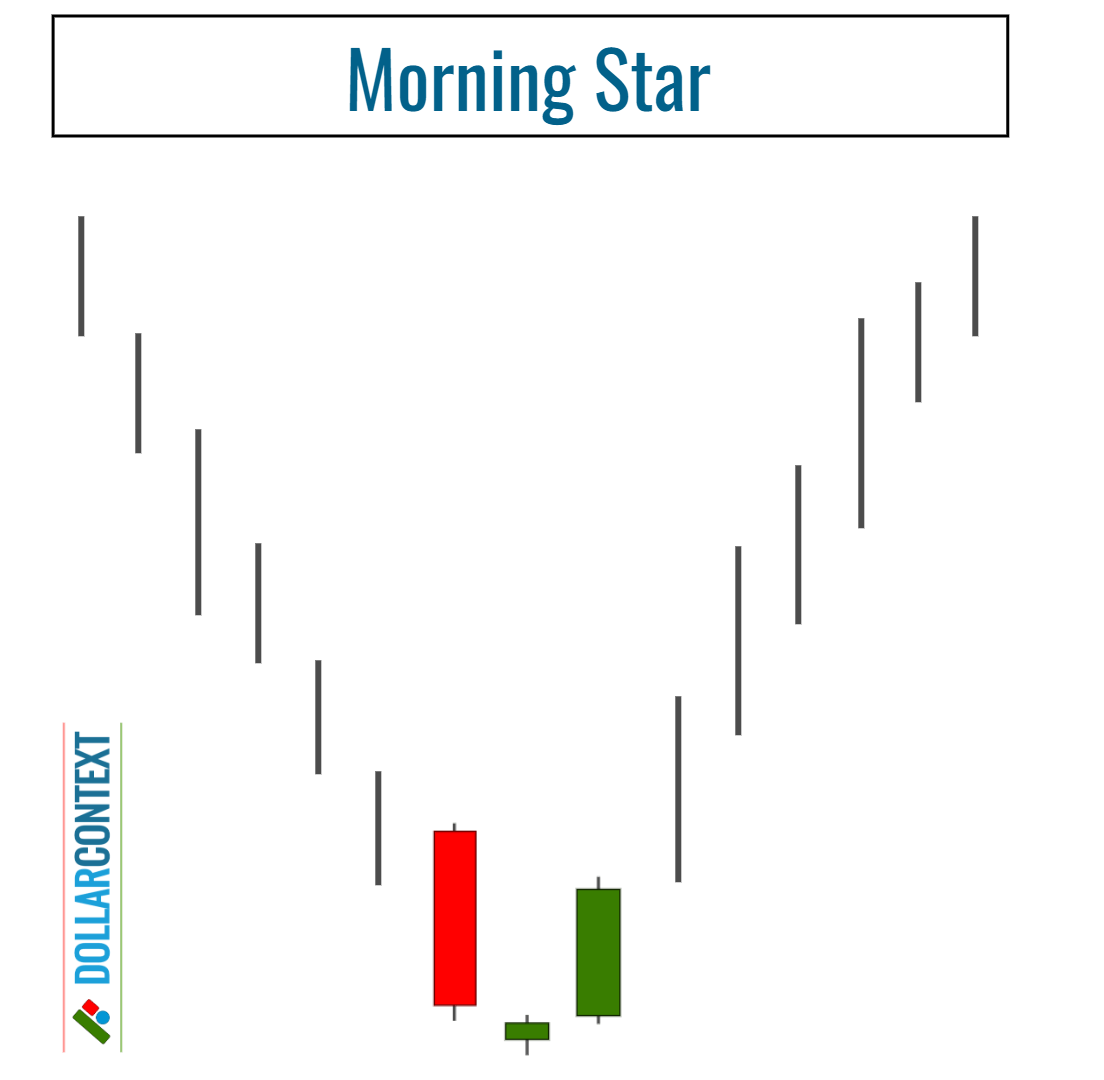

The morning star is a bullish reversal pattern that arises at the end of a downtrend. It consists of three characteristic candlesticks:

- A long bearish (red or black) candle, indicating strong selling activity.

- A small-bodied candle (either bullish or bearish), representing indecision and suggesting that the downward momentum may be waning. Ideally, this small candle should not touch the real body of the first session.

- A long bullish (green or white) candle, confirming the reversal and indicating strong buying activity. The third session usually closes well into the red candlestick that makes up the first candle of the pattern.

The morning star pattern indicates that the market sentiment has shifted from bearish to bullish. It is often used by traders as a signal to consider exiting short positions or opening long positions.

Here are various strategies for entry points after the emergence of a morning star pattern:

Morning Star-Based Entry Techniques

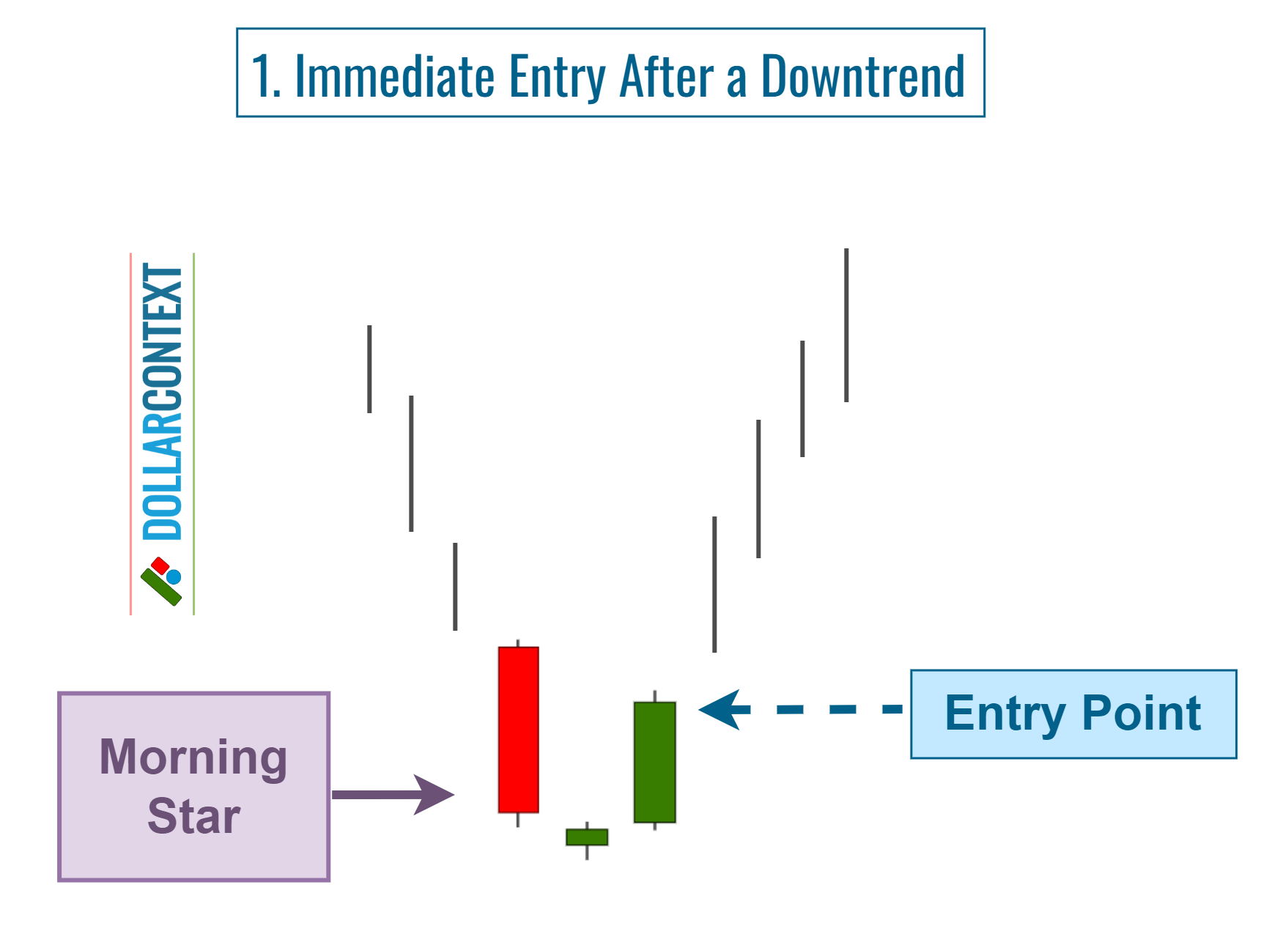

1. Immediate Entry

As soon as a morning star appears after a defined and advanced downtrend, it may be an opportunity to open a long position.

This approach is more aggressive and can be implemented when expecting a swift change in market direction.

- Advantages: You will not miss the chance to trade.

- Disadvantages: You're entering a position without further confirmation.

We recommend adopting this strategy only if the market is definitely oversold, the star (second session of the pattern) gaps below the first body, and the third candle penetrates well into the first.

We don't recommend this method when trading on lower timeframes, such as hours or minutes. The rationale behind this is that the gap between the first and second candles is much less likely in such situations.

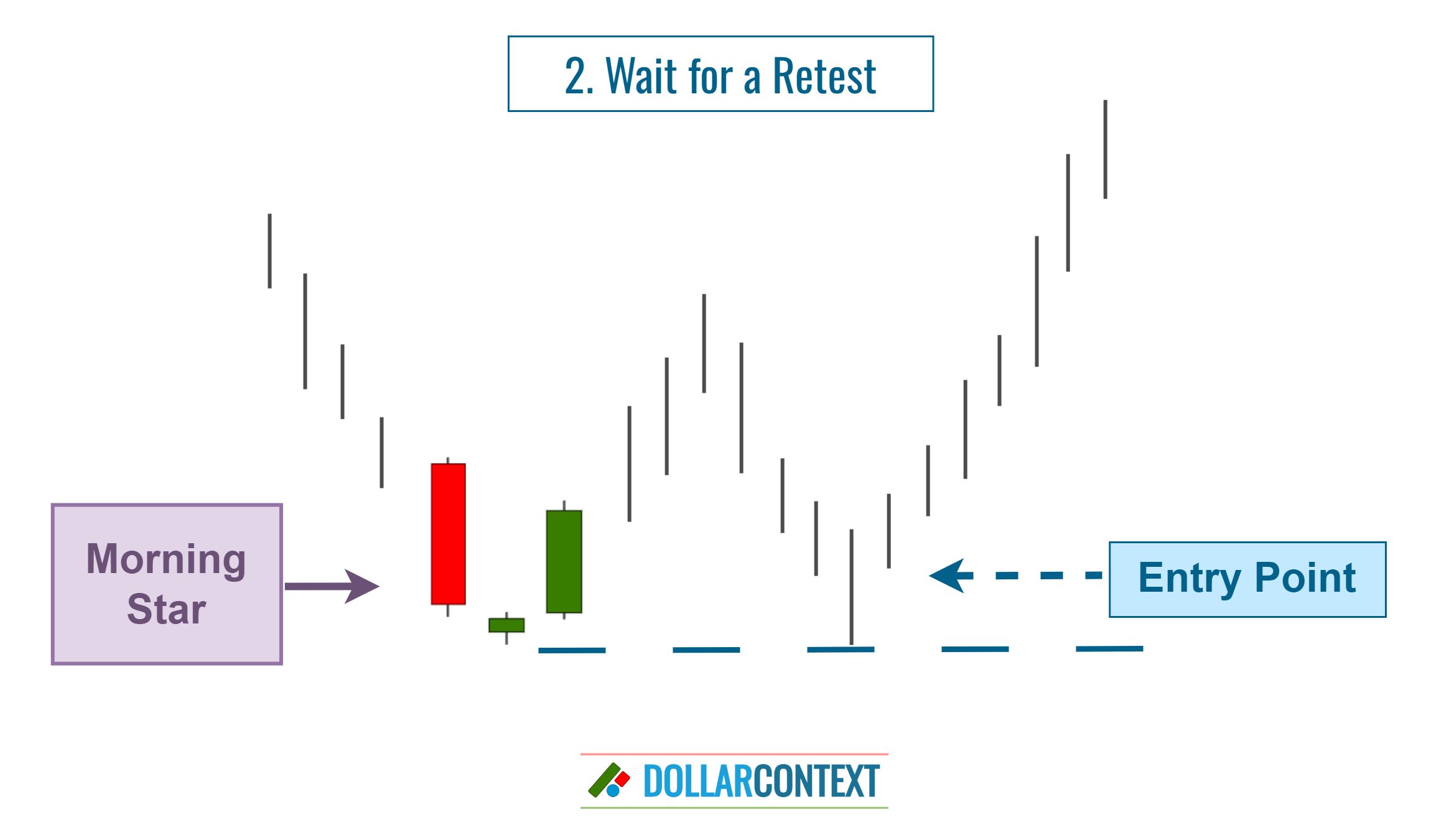

2. Wait for a Retest

Following a solid downtrend, the appearance of a morning star followed by a market upturn doesn't necessarily eliminate remaining selling pressure. This lingering momentum could prompt the market to retest the lows set by the morning star before beginning a more definitive uptrend.

Some traders opt to hold off on initiating a long position until the price retests the lows established by the morning star. Bear in mind that following a downtrend, the morning star creates a support zone. You can use this approach to validate that the support level, indicated by the low of the morning star pattern, holds. Also, this level can serve as a reference for setting your stop-loss when implementing a morning star strategy.

- Advantages: A successful retest of the support established by the morning star provides additional validation, thereby reinforcing the pattern's credibility as a bottom reversal indicator.

- Disadvantages: Given that the lows of the morning star aren't always revisited, you could potentially overlook a chance to trade.

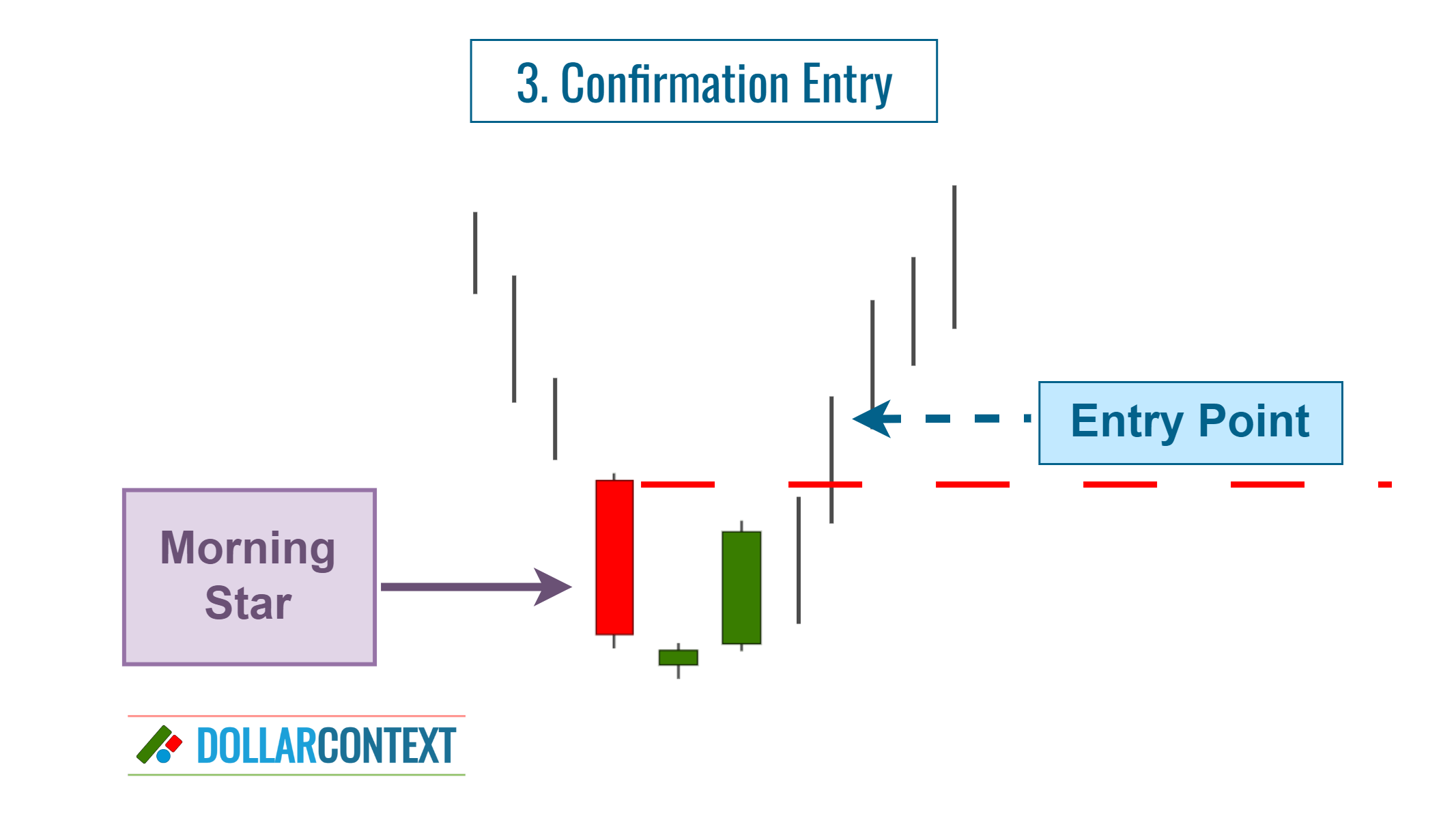

3. Confirmation Entry

This is the most traditional approach in Japanese candlestick techniques. To implement it, just await the next candle to confirm the market's direction after the morning star. That is, consider opening a short if the subsequent session is bullish and closes above the highs of the morning star formation.

- Advantages: This strategy serves to confirm the market's direction following the emergence of a morning star.

- Disadvantages: The risk-to-reward ratio worsens.

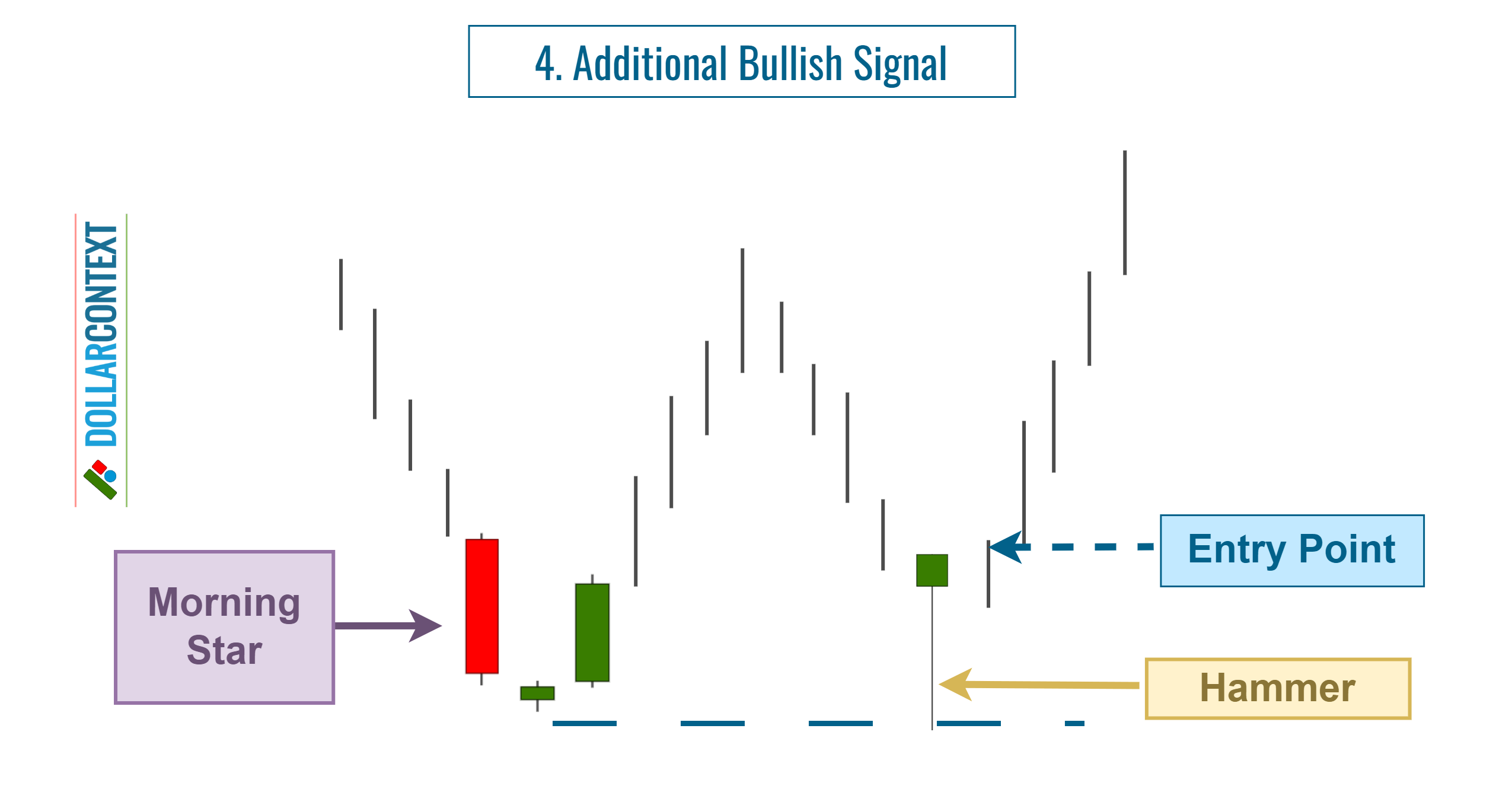

4. On an Additional Reversal Signal

If a morning star appears after a downtrend, wait for additional bullish indicators before opening a long position. These could manifest as a hammer, a piercing pattern, or another bullish signal.

Keep in mind that such confirming signals could also appear before the morning star pattern.

- Advantages: A bullish reversal pattern that either precedes or succeeds the morning star reinforces its credibility as a bottom reversal signal.

- Disadvantages: If no additional candlestick pattern emerges within the price range of the morning star formation, you risk missing a trading opportunity.

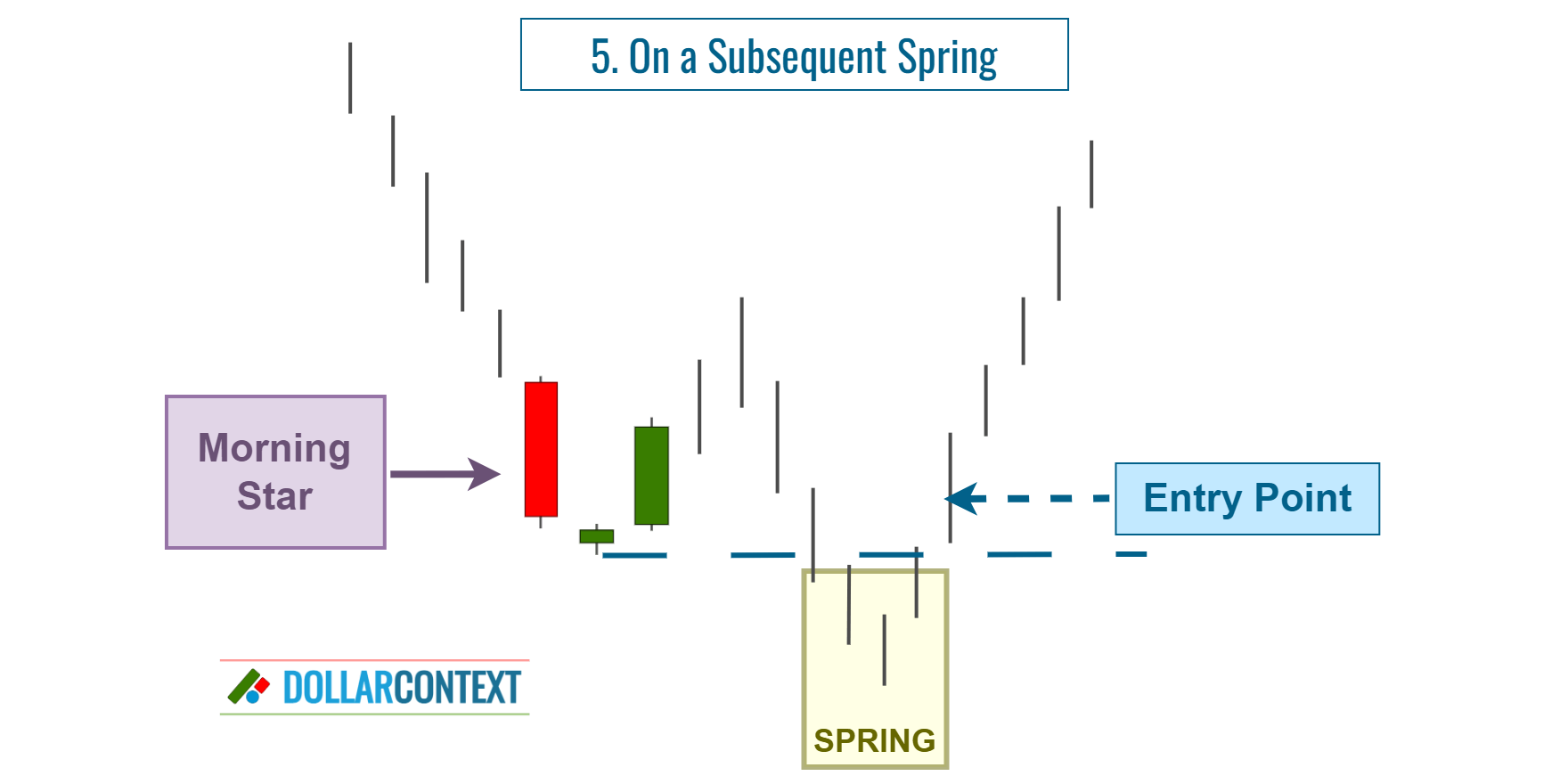

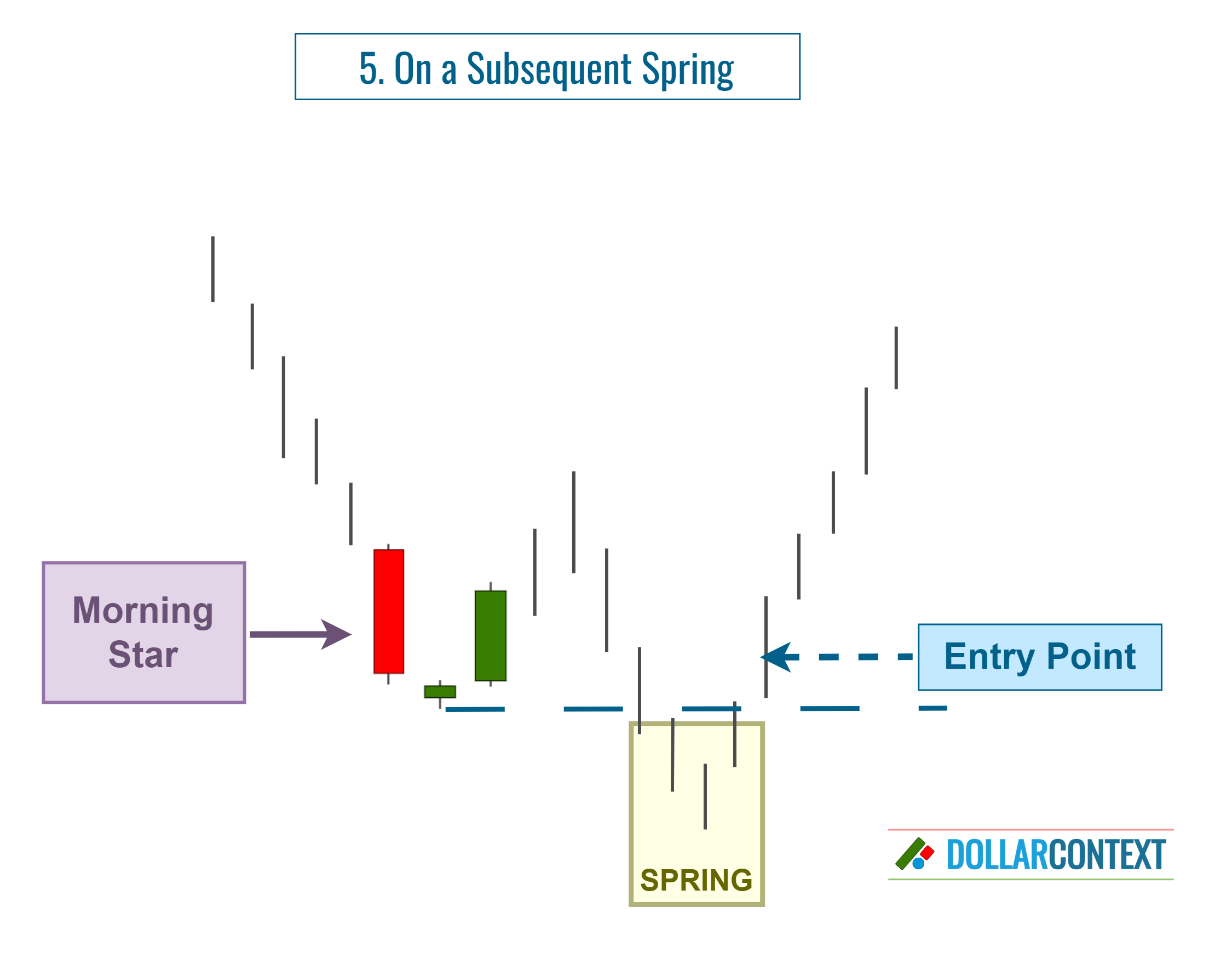

5. After a Spring

A spring happens when the market briefly breaks through a support level, only to quickly reverse course and move in the opposite direction. Essentially, it acts as a false breakout to the downside that serves as a bullish reversal indicator.

Springs frequently occur in markets and can serve dual purposes: to confirm a reversal as signaled by a pattern, such as the morning star, and to set a stop-loss level below the spring's bottom.

- Advantages: After a spring, the probability of a bullish trend reversal rises substantially.

- Disadvantages: The updated stop-loss should be determined by the low points of the spring, positioning it further away from the entry point.

Though springs are not a certainty, when they do occur, executing the morning star strategy with a stop set at the bottom of the spring is generally a reliable tactic.