Morning Star: Limitations and Criticisms

While the morning star can serve as a useful instrument for traders, it's important to keep in mind its limitations and the skepticism that surrounds this pattern.

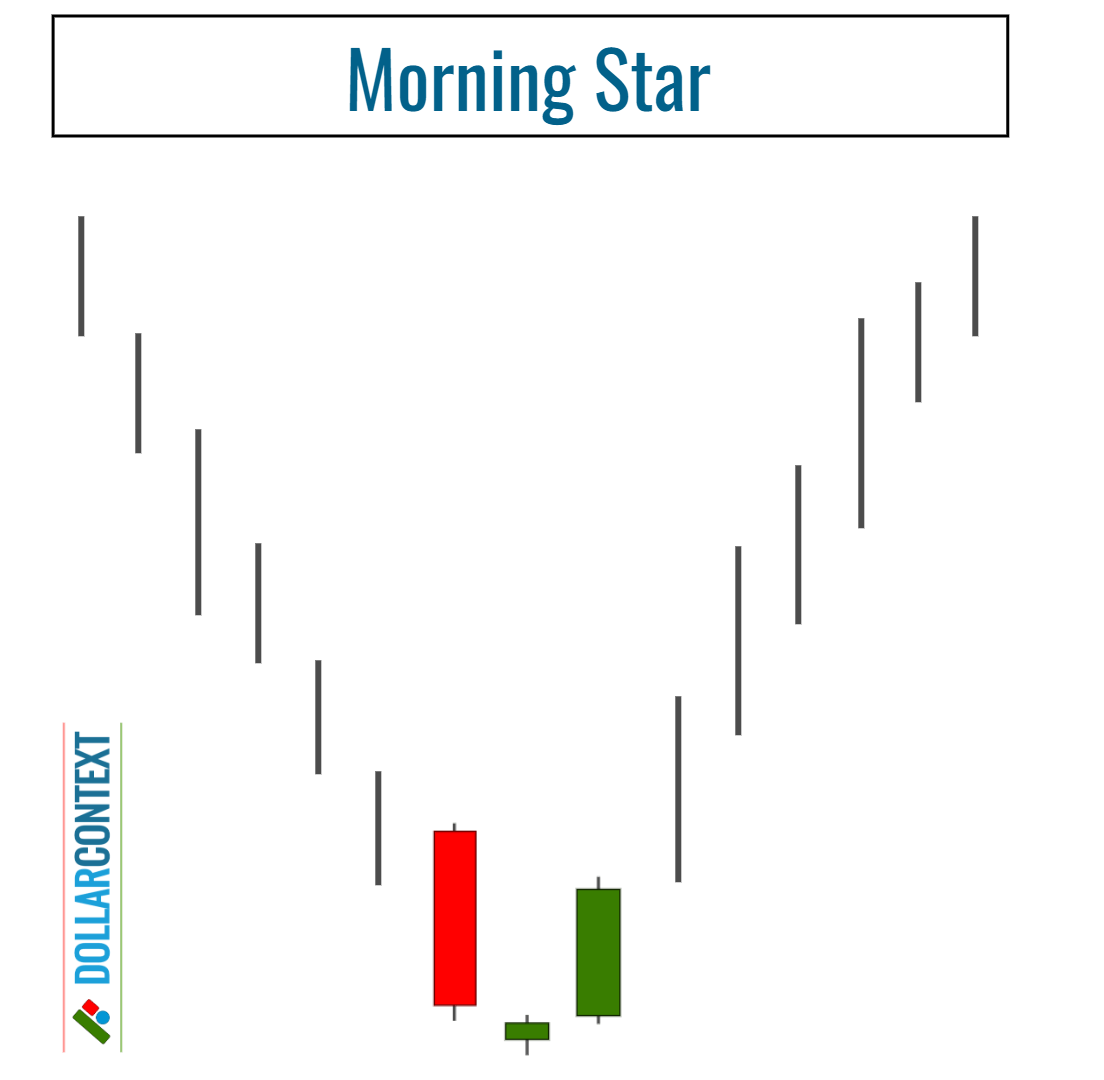

The morning star is a bullish reversal pattern that occurs at the end of a downtrend. It consists of three candles: a long red candle, a smaller-bodied candle that gaps down, and a long green candle that closes well into the first candle's body. This formation signals a potential trend reversal from bearish to bullish.

Here are the most important limitations and criticisms of the morning star pattern.

1. Subjectivity

The identification of a morning star pattern can vary based on individual interpretation and trading styles.

Certainly, not all morning stars are equally significant. The pattern's significance is shaped by various factors, like the size of the first real body, the gap between the first and second candles, the closing price of the third green candle, and other contextual elements. All of them may add an extra level of subjectivity.

The ideal version of a morning star is composed of three candlesticks:

- A long red candle indicating strong selling pressure.

- A small-bodied candle that gaps below the first, showing decreasing momentum.

- A long green candlestick that opens above the second and closes well into the body of the first, validating a potential trend reversal.

Having said that, the morning star pattern in practice doesn't have to exactly match the textbook illustrations to provide a valid trading signal. According to theory, morning star variations can still deliver key insights into market conditions, introducing a certain level of subjectivity.

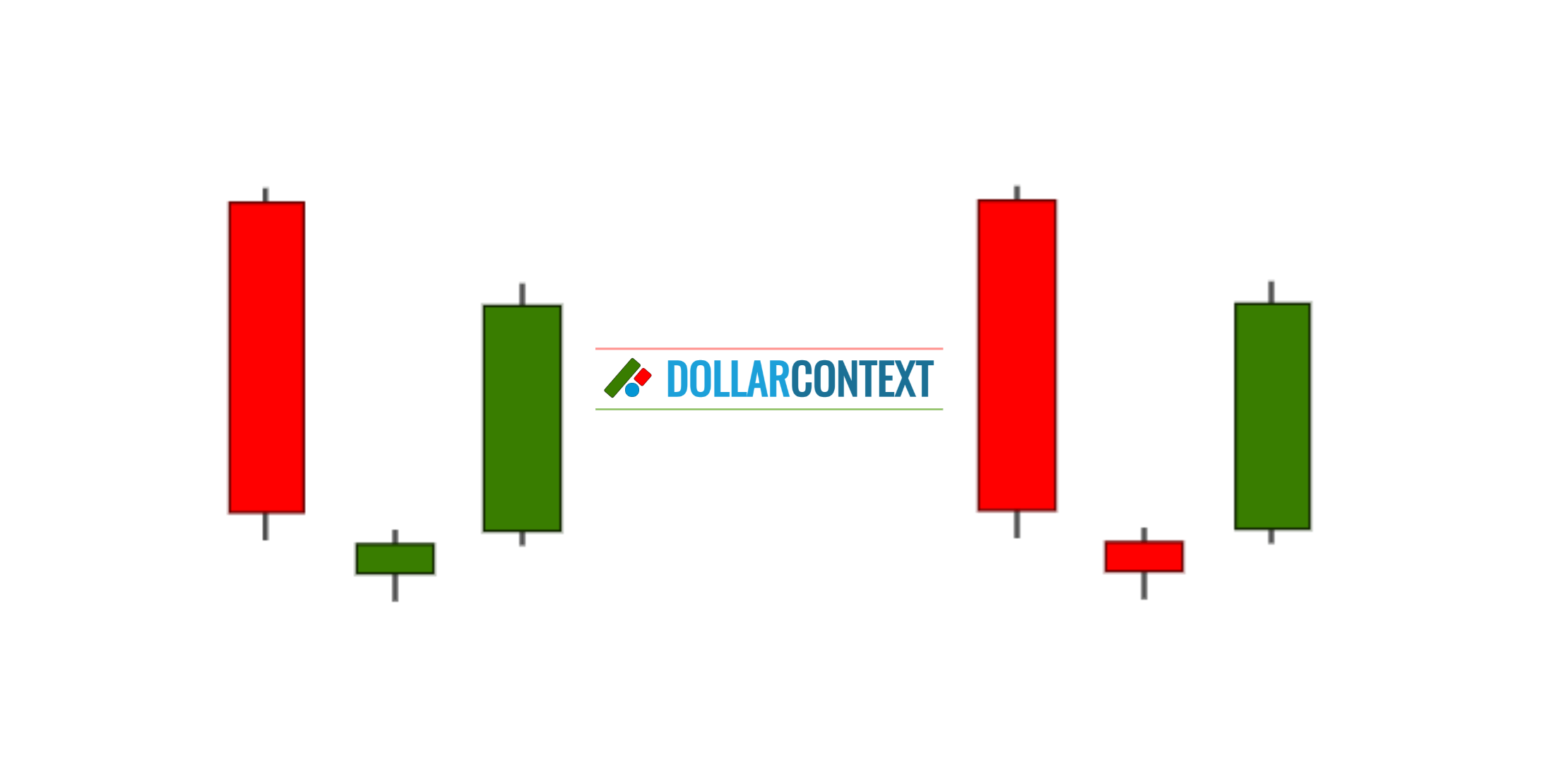

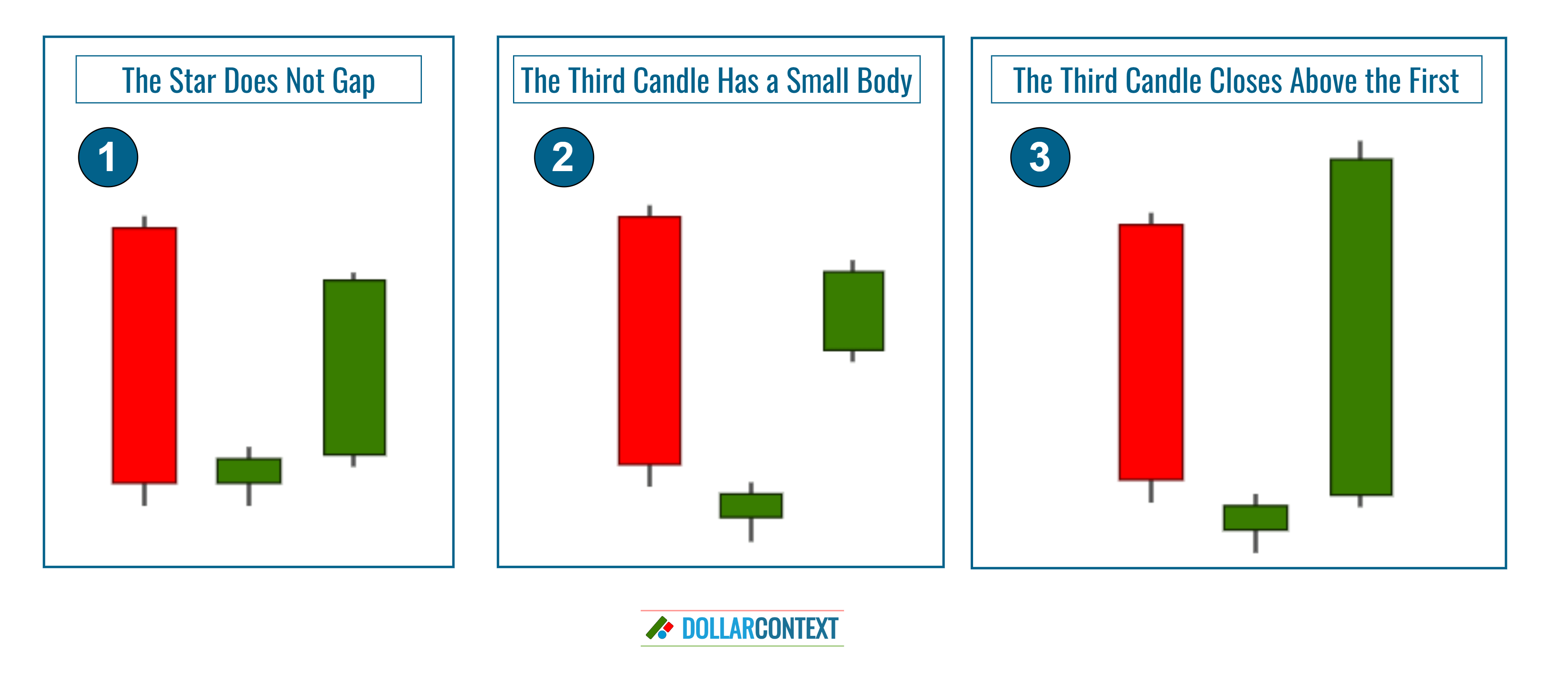

Below are some frequently encountered variations of the morning star pattern:

- No Gap Between the First and Second Candles: This is pretty common in shorter timeframes and low-volatility markets. In such cases, waiting for further confirmation of an uptrend is typically recommended before opening a long position.

- The Third Candle Has a Small Green or White Body: In these instances, make sure the third candlestick closes well within the body of the first one. If it doesn't, consider seeking additional confirmation before acting.

- The Third Candle Closes Above the Opening of the First: This frequently happens after established or mature downtrends. A pronounced third candle indicates a shift in market sentiment, potentially heralding the beginning of a bull market.

2. Dependence on Context

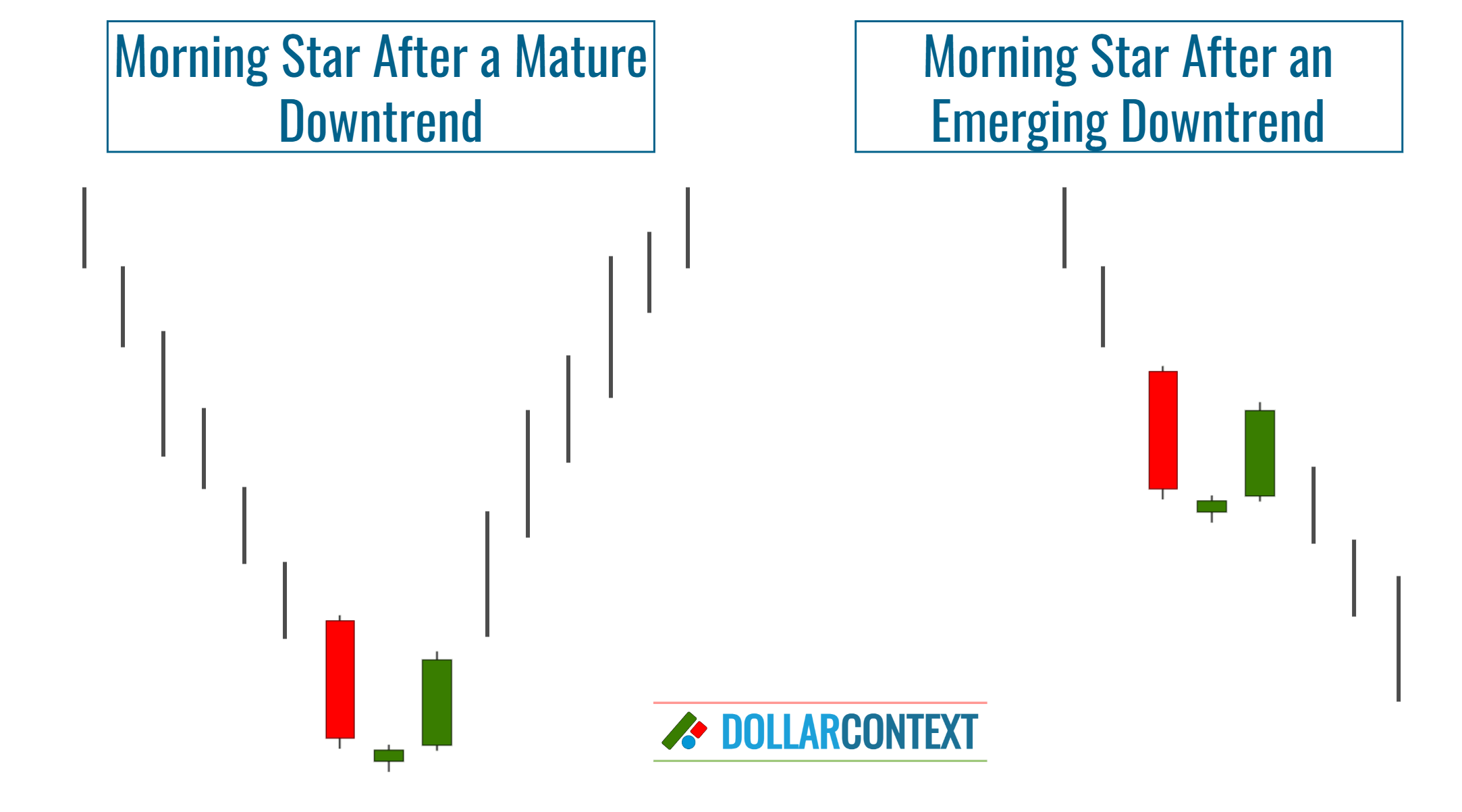

The effectiveness of a morning star in signaling a bullish trend reversal is largely dependent on the preceding downtrend.

- After a mature downtrend, a morning star is generally seen as a sign of an impending bullish shift.

- After an uptrend or without a clear trend, the morning star pattern typically lacks relevance.

This reliance on the preceding trend raises two relevant questions:

- How long should a trend last to be considered mature or extended enough?

- What degree of price movement is required for a downtrend to be categorized as significant?

3. Need for Confirmation

Some traders overemphasize a single pattern while neglecting the wider market context. This limited perspective can result in hasty or misguided trading choices.

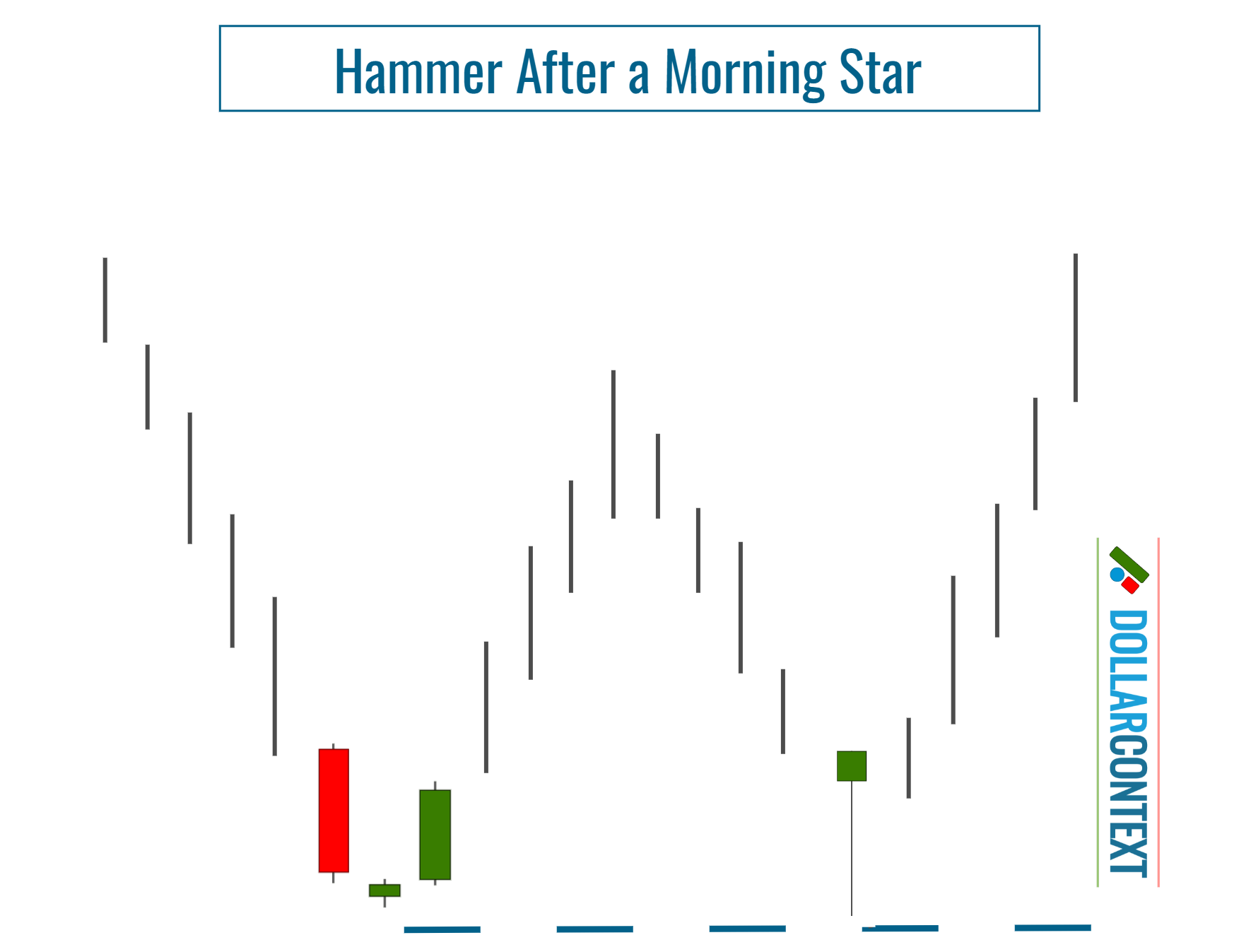

A morning star pattern is not a foolproof indicator of a bottom reversal. Seasoned traders often look for further validation, either through subsequent candlestick patterns or other indicators, before entering a trade.

4. False Signals

Like any other technical indicator, morning stars may produce false signals. Relying solely on a particular pattern without proper risk management can result in significant financial losses.

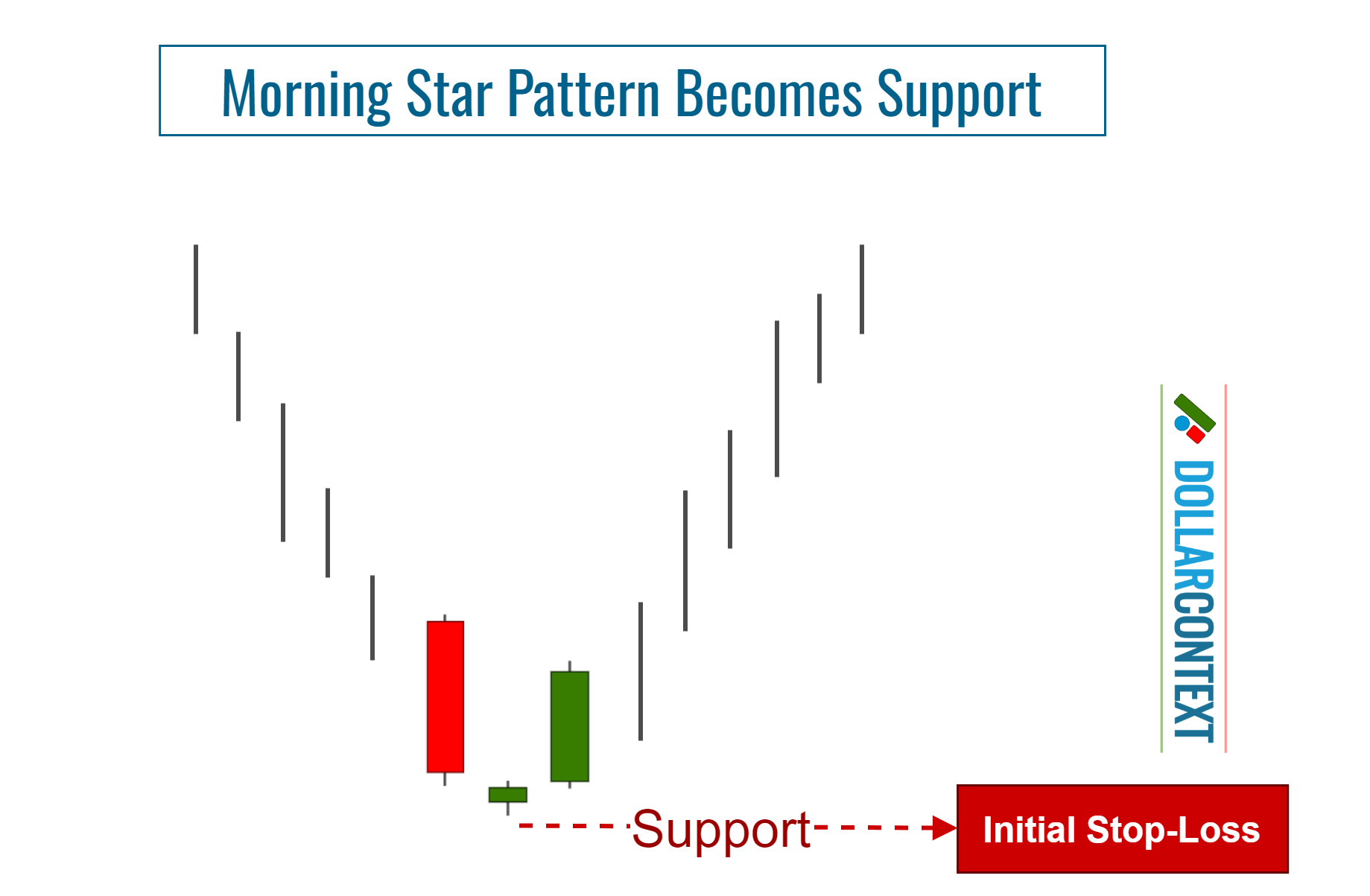

Using a stop-loss level is key when implementing a trading strategy centered around the morning star pattern. Following a downtrend, the lowest point of a morning star turns into a support level. This point can serve as the initial placement for your stop-loss with a morning star strategy.

5. False Breakouts

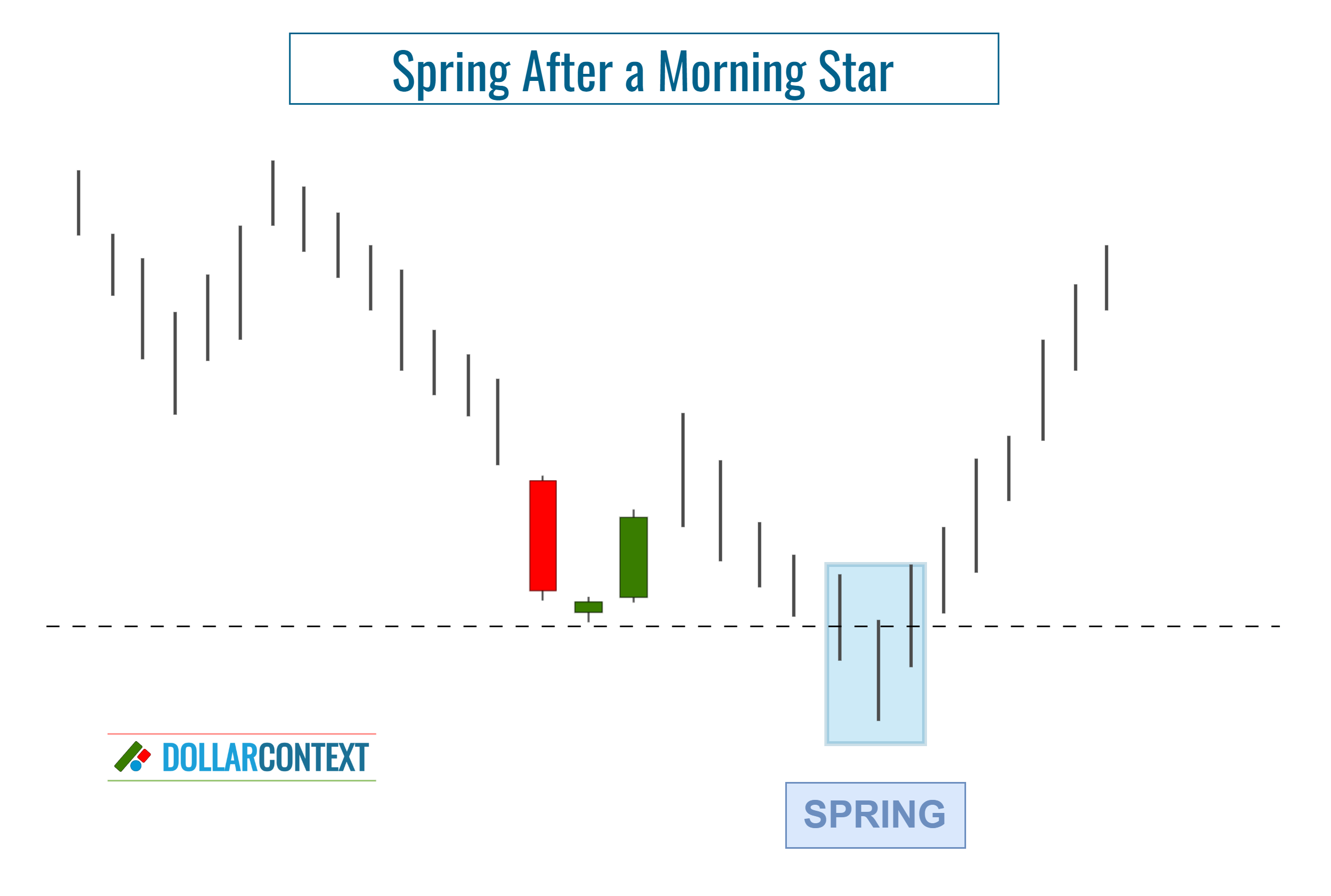

A false breakout denotes a scenario in which the market momentarily breaches a support or resistance level, but quickly reverses its course to head in the opposite direction.

Springs are false breakouts that happen to the downside. Due to their relatively common occurrence after the morning star pattern, they can confuse traders and cause unnecessary stop-outs.

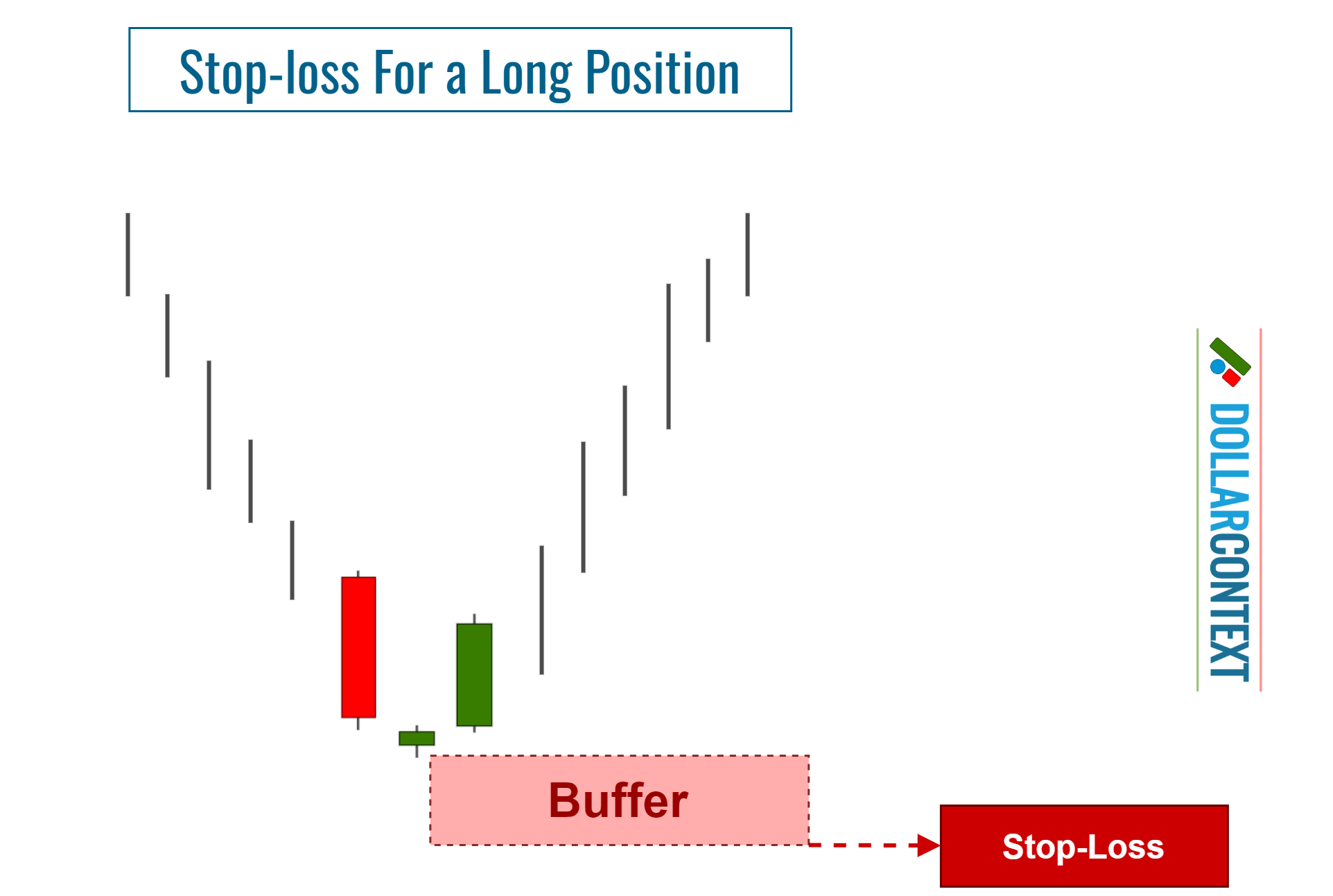

To protect against false breakouts, incorporating a buffer into the initial stop-loss could be beneficial.

6. Frequency

Variations of the morning star pattern can show up often in certain markets, especially when using hourly timeframes. However, they don't always signal a notable shift in price, reducing their reliability as an isolated indicator.

7. Overemphasis

Some traders overemphasize the importance of individual patterns, such as the morning star, while overlooking critical elements of trading like risk management.

8. Undefined Magnitude of the Result

Though morning stars can indicate trend reversals and potential entry opportunities, they don't provide specific guidance on when to take profits. To set profit targets, traders generally rely on other methods like classical chart patterns, Fibonacci projections, or moving averages.

Conclusion

While the morning star can be a valuable tool for traders, it's essential to understand its limitations and the caution it sometimes warrants. Rather than using it as a standalone signal, this pattern is more effective when combined with other technical or fundamental analysis methods.

Adopting this comprehensive approach allows traders to maximize the benefits of recognizing morning star patterns, while reducing the risks associated with relying solely on them.