The Psychology Behind a Morning Star

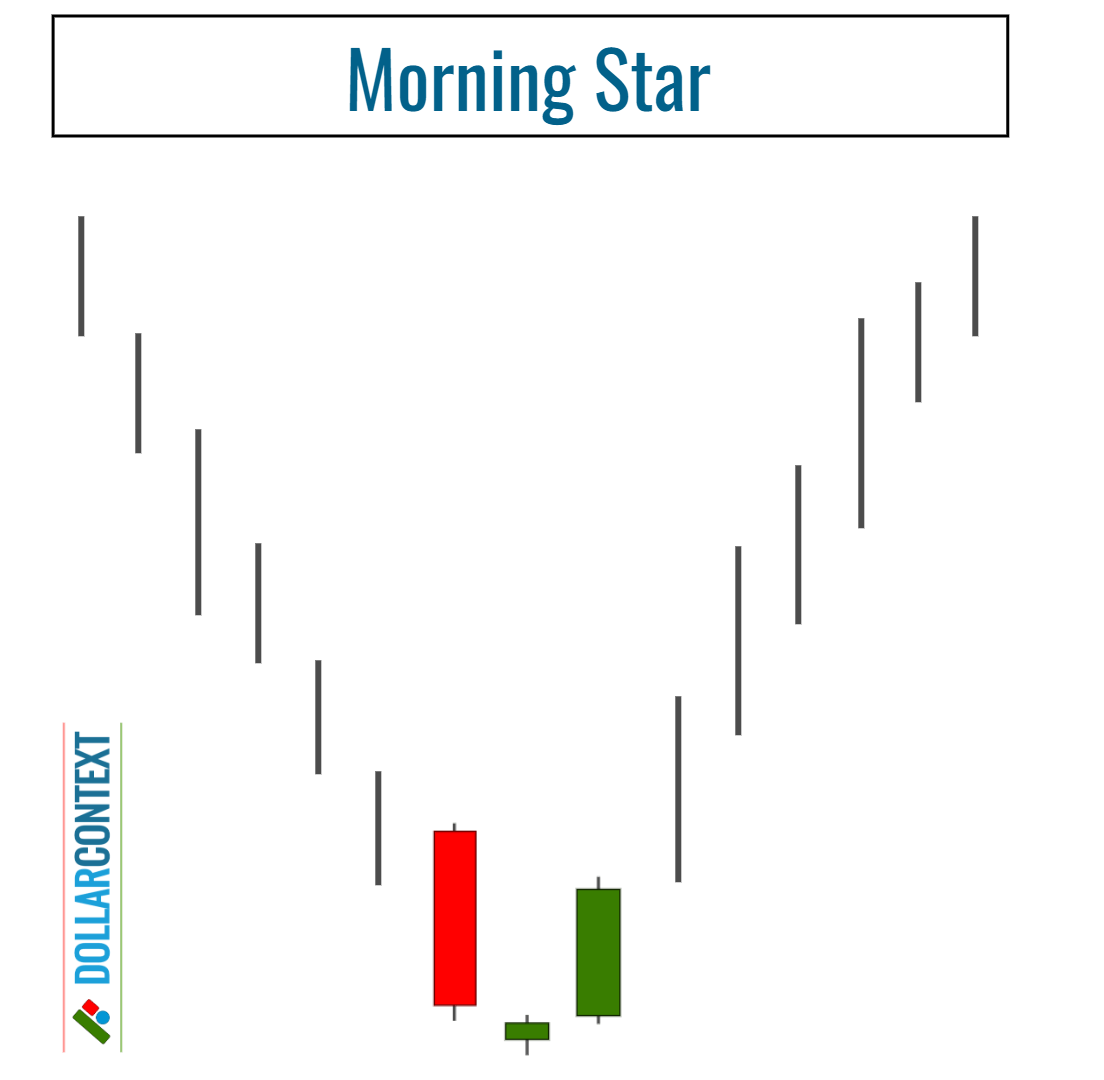

The psychology behind a morning star pattern reveals a shift in market sentiment from bearish to bullish, usually occurring after a downtrend.

In Japanese candlestick analysis, the morning star is a bullish reversal pattern that consists of three candlesticks:

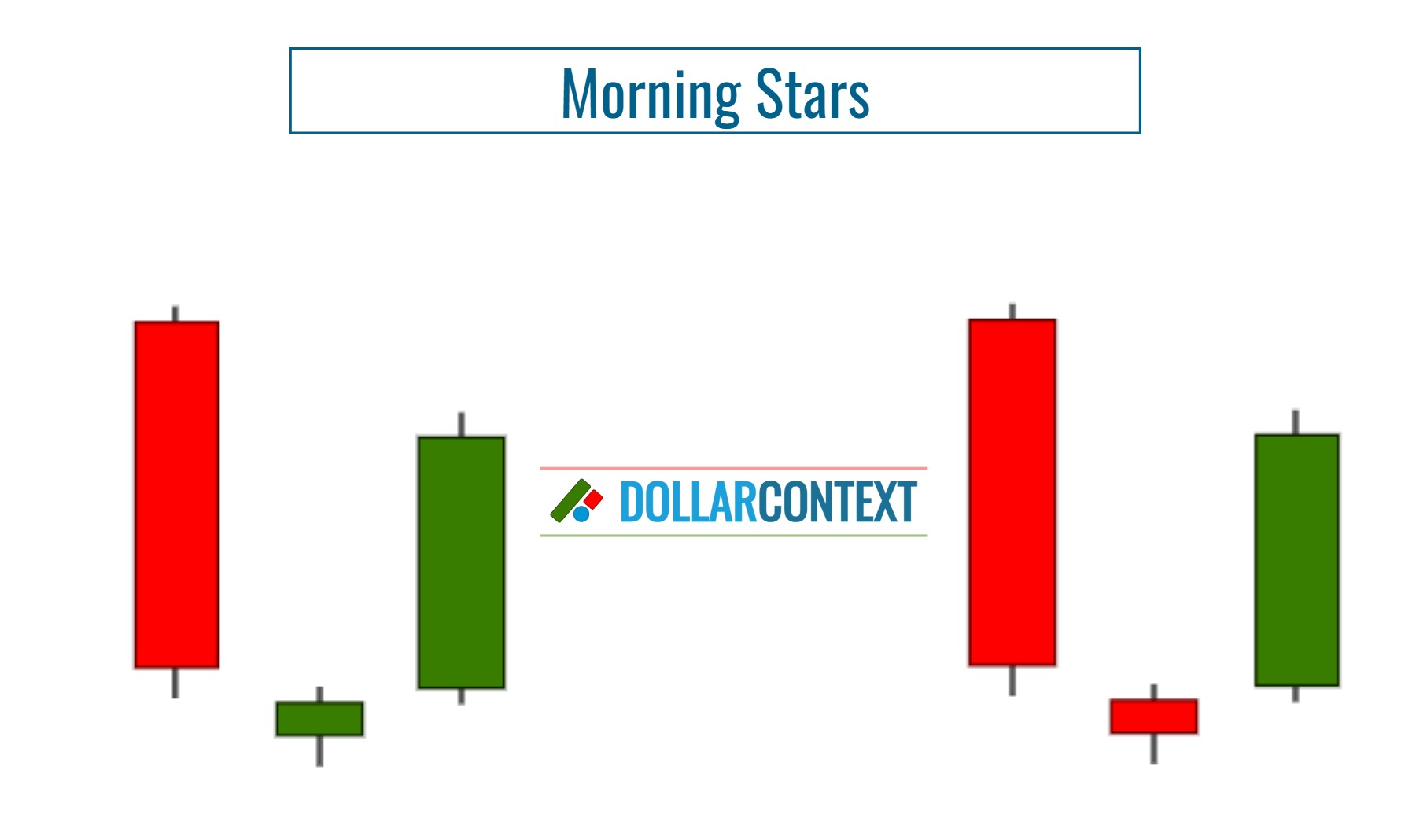

- The first is usually a large red candle.

- The second is a small-bodied candle that gaps below the first.

- The third is a green candle that typically closes above the midpoint of the first candle, conveying a potential reversal from a downtrend to an uptrend.

The psychology behind the morning star reveals a shift in market sentiment from bearish to bullish, usually occurring after a pronounced downtrend. Here's how it unfolds:

- First Candlestick (Bearish): The pattern starts with a strong bearish candle, representing a continuation of the prevailing downtrend. At this point, sellers are fully in control, and there's widespread pessimism.

- Second Candlestick (Indecision): The next session opens lower, but it reflects uncertainty, resulting in a small-bodied candle or sometimes a doji. This proves that sellers are losing momentum and a sense of indecision or hesitation is injected into the market. The body of the second candlestick can be green or red.

- Third Candlestick (Bullish): The final candle is a strong bullish one that closes well into the body of the first candle, typically above its midpoint. This suggests that the bulls have taken over and the sentiment has officially turned positive.

The shift from strong selling interest to uncertainty and finally to strong buying interest is a classic indicator that the previous downward momentum is wavering and could be about to reverse, making the morning star a powerful pattern for traders.