Morning Star: How to Set Your Stop-Loss

In this post, we'll explore effective strategies to set a stop-loss when using a morning star pattern to initiate a long position.

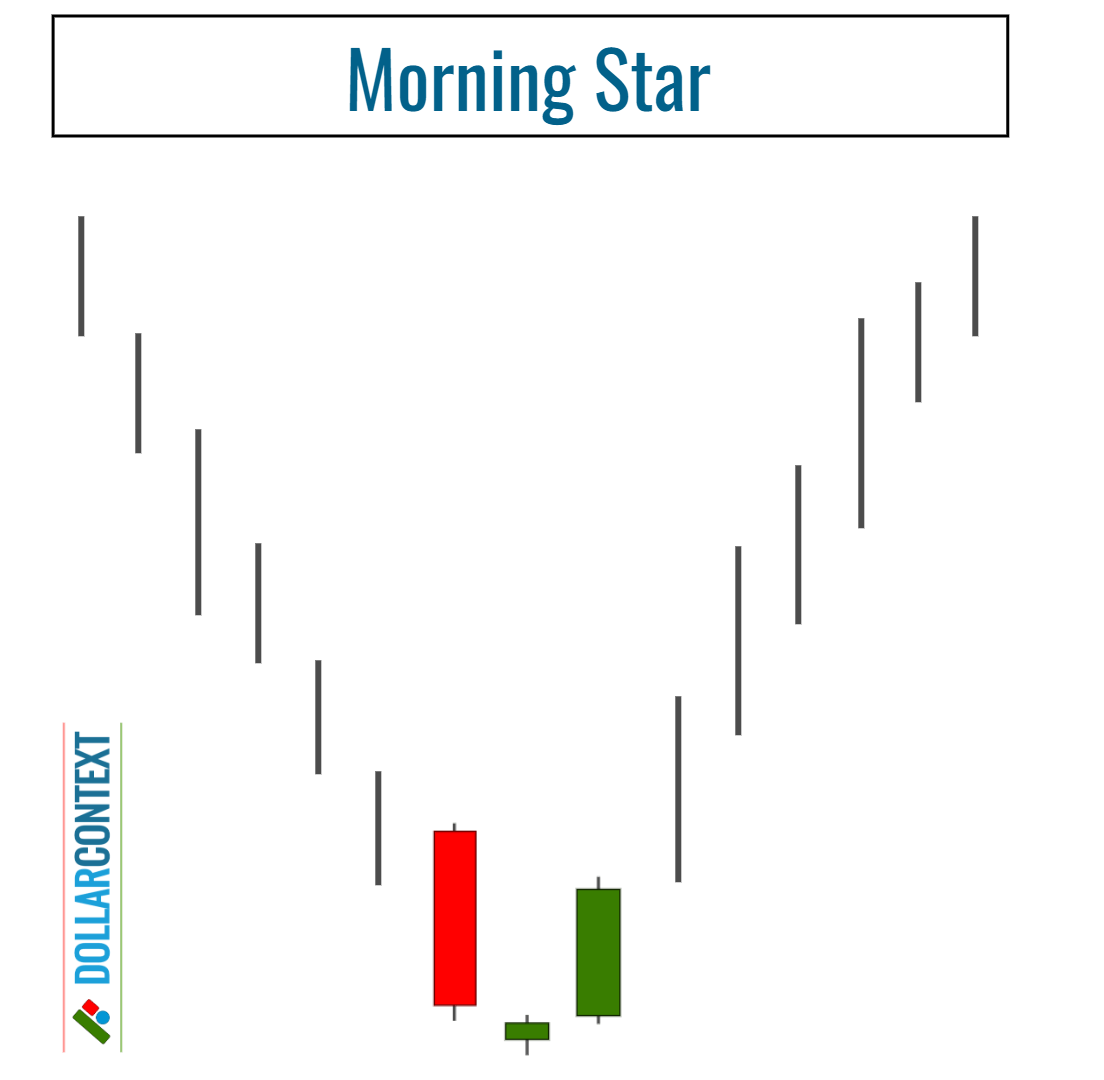

In Japanese candlestick analysis, the morning star is a bullish reversal pattern that occurs after a downtrend.

Here are detailed, step-by-step instructions for setting a stop-loss when initiating a trade based on the morning star pattern.

1. Correct Identification

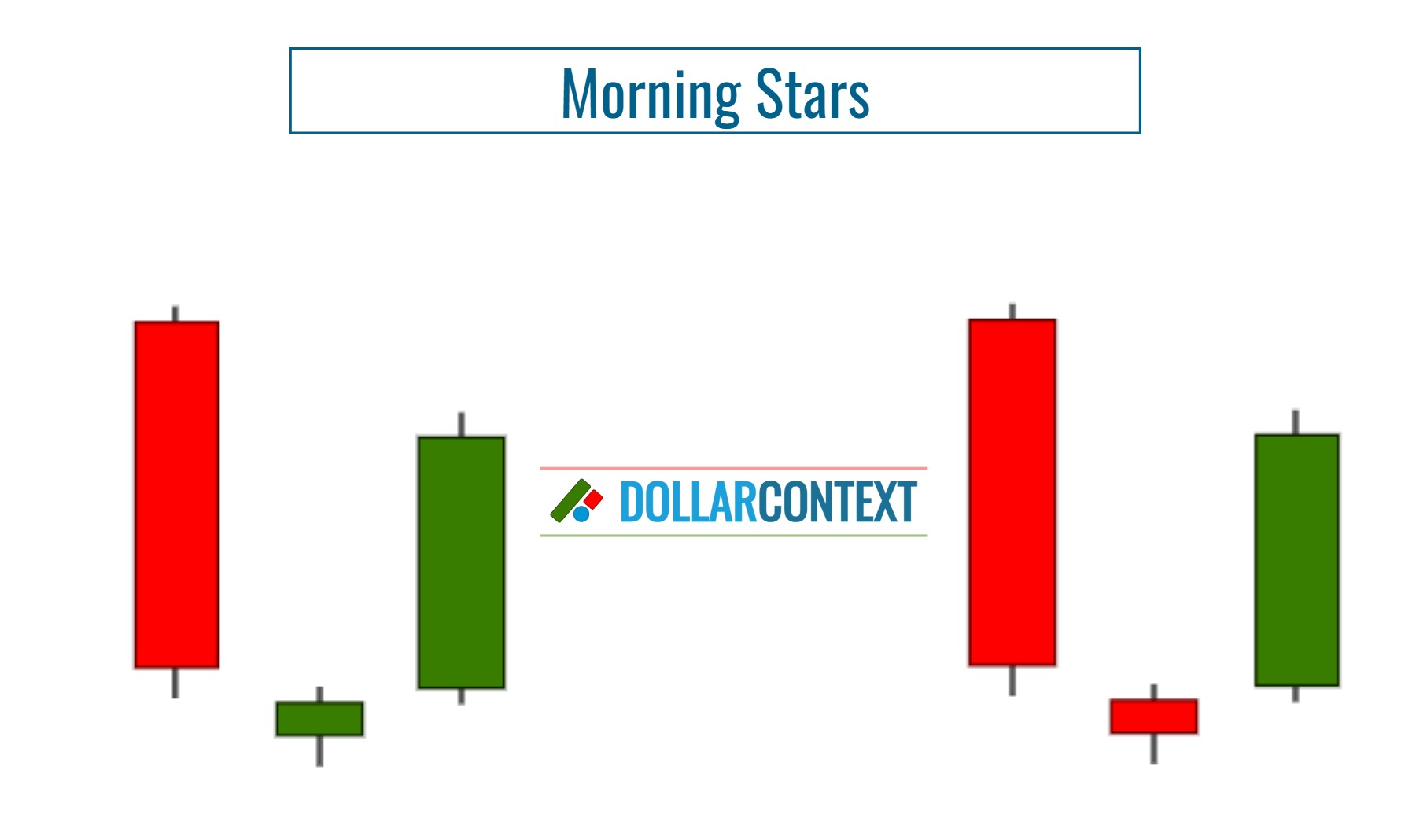

Make sure that you correctly identify the morning star on your chart. The pattern consists of three candlesticks that emerge after a downtrend:

- A long bearish (red) candle, representing strong selling activity and continuation of the preceding downtrend.

- A small-bodied candle (which can be either bullish or bearish), suggesting market indecision. Ideally, this candle should gap below the closing price of the first candle, showing a potential exhaustion of the previous bearish trend.

- A long bullish (green) candle, indicating strong buying activity and confirming the reversal. This candle usually closes well into the body of the first bearish candle.

2. Verify the Previous trend

From a psychological standpoint, the morning star signals a possible change in market mood. However, for a trend bottom reversal to occur, a distinct downward trend must precede the morning star pattern.

In a market that's trending sideways or displaying a mild trend, a morning star usually carries little significance.

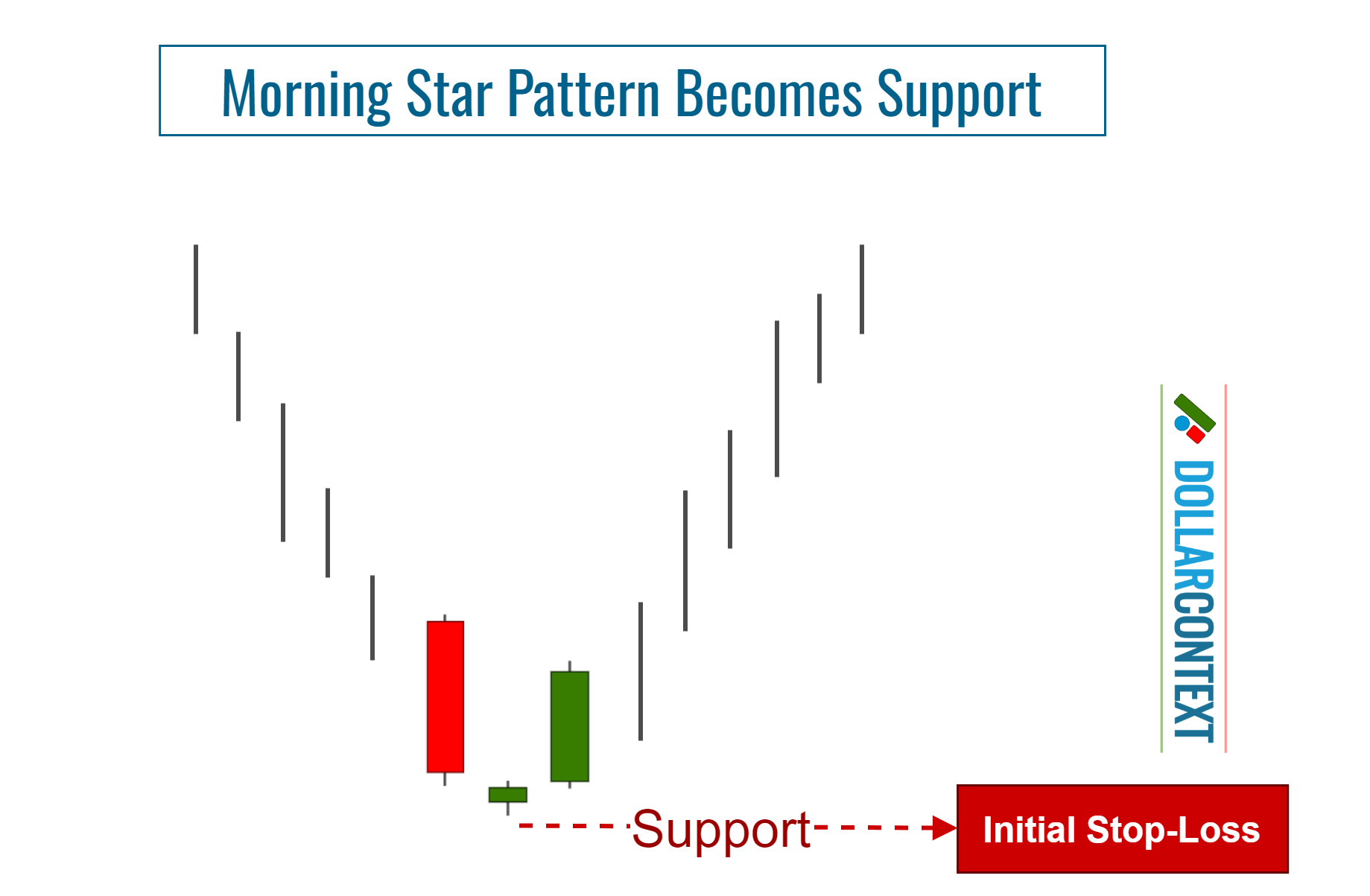

3. Identify the Support Zone

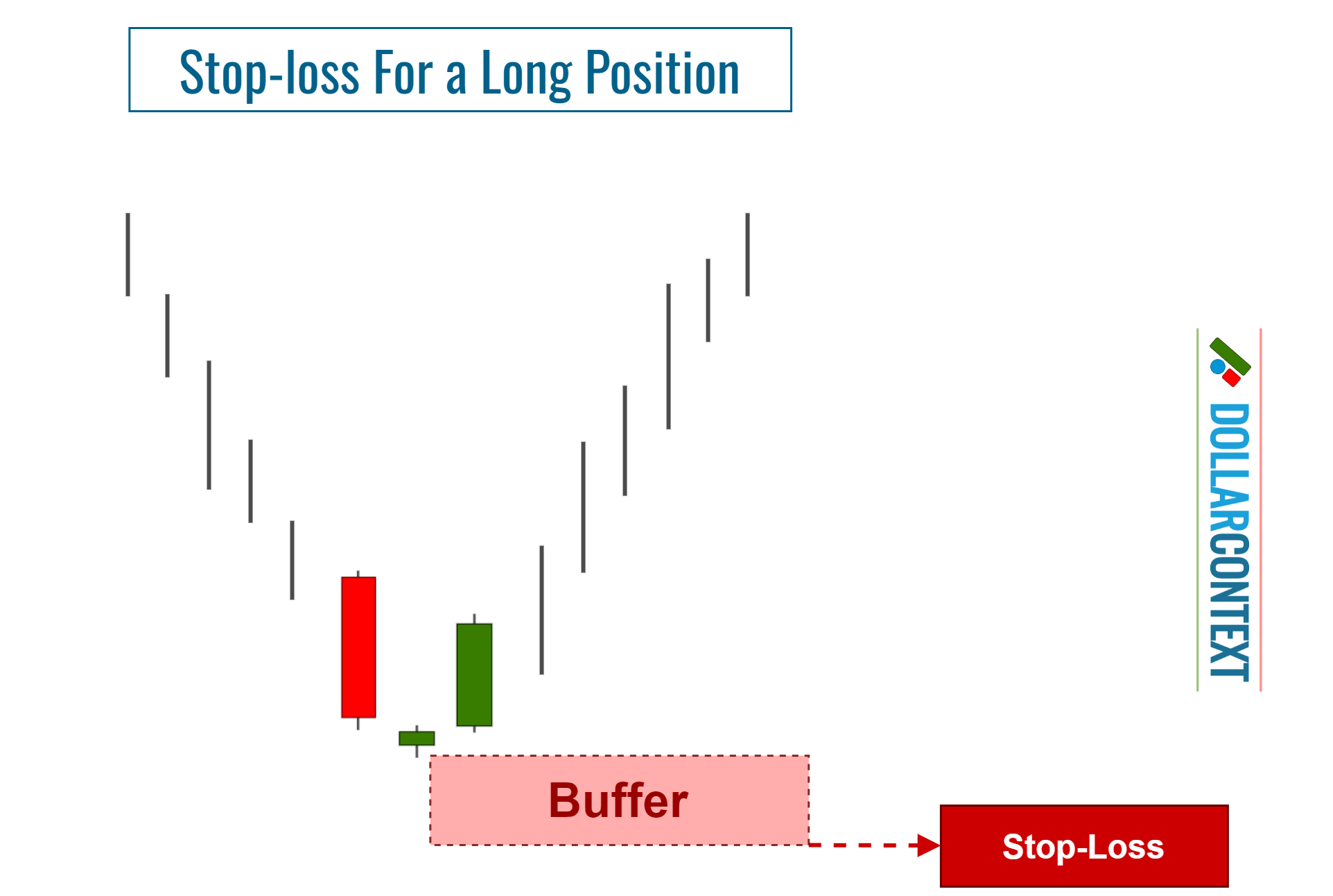

After a downtrend, the price range linked to a morning star becomes support. The lows of this range can serve as a reference point for setting your initial stop-loss when opening a long position after this pattern.

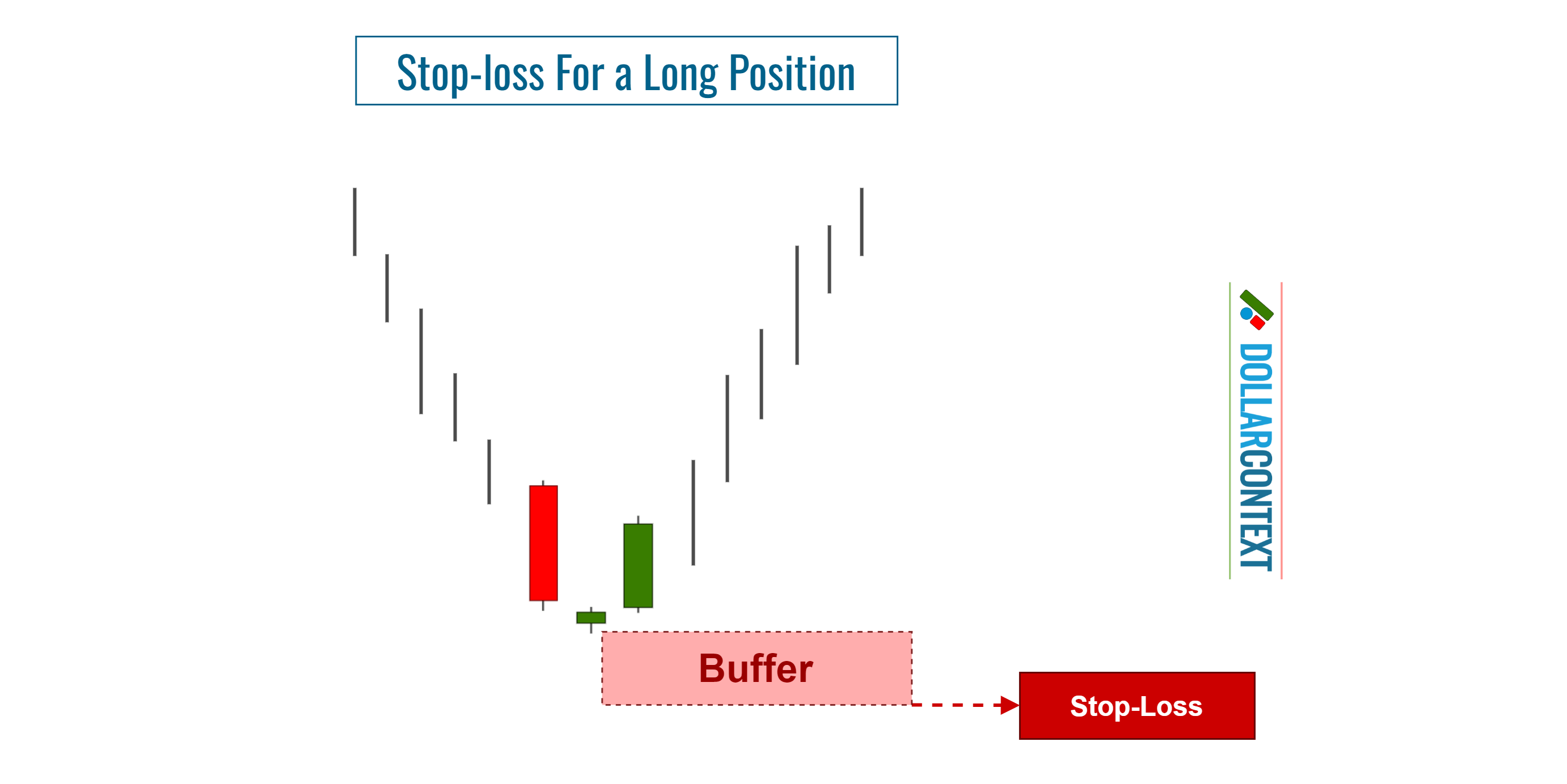

4. Consider Adding a Safety Margin

After considering factors like risk management and market volatility, you may decide to include a cushion to your initial stop-loss. This extra measure can help shield you from false breakouts to the downside.

5. Determine If Your Stop-Loss Is Based on a Closing Price

A stop activated at close is triggered when the closing price of the candlestick crosses the stop-loss level, rather than merely depending on intraday price movements.

In the domain of Japanese candlestick analysis, it is typically recommended to set a stop at the closing price, especially when employing a morning star pattern to open your position.

6. Monitor the Trade

Regularly review both the market and your position to ensure they align with your morning star strategy. Specifically:

- Adjust Your Stop-Loss When Necessary: Given the dynamic nature of markets, fresh candlestick patterns may emerge as your trade progresses. In these situations, it's advisable to recalibrate your stop-loss to align with the changing market conditions. For example, if a new candlestick pattern emerges within the price range of the morning star, validating the bullish reversal theory, adjusting your stop accordingly would be wise.

- Adjust as the Price Moves in Your Favor: Consider using a trailing stop-loss to secure gains and efficiently control risk.

- Maintain Discipline: Stand firm against making decisions based on emotions, no matter the market's behavior.