Types of Morning Star Patterns

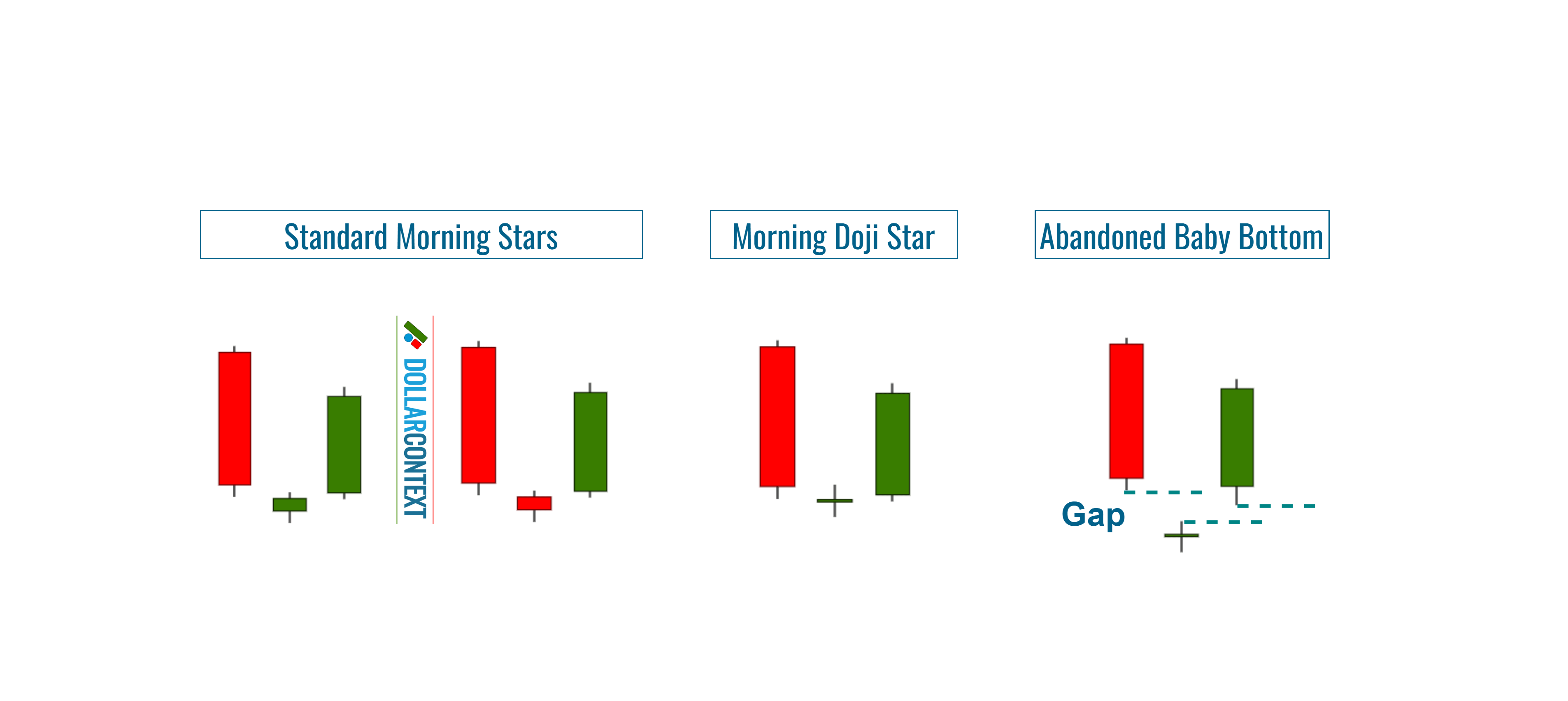

We can distinguish three primary types of morning stars: standard morning star, morning doji star, and abandoned baby bottom.

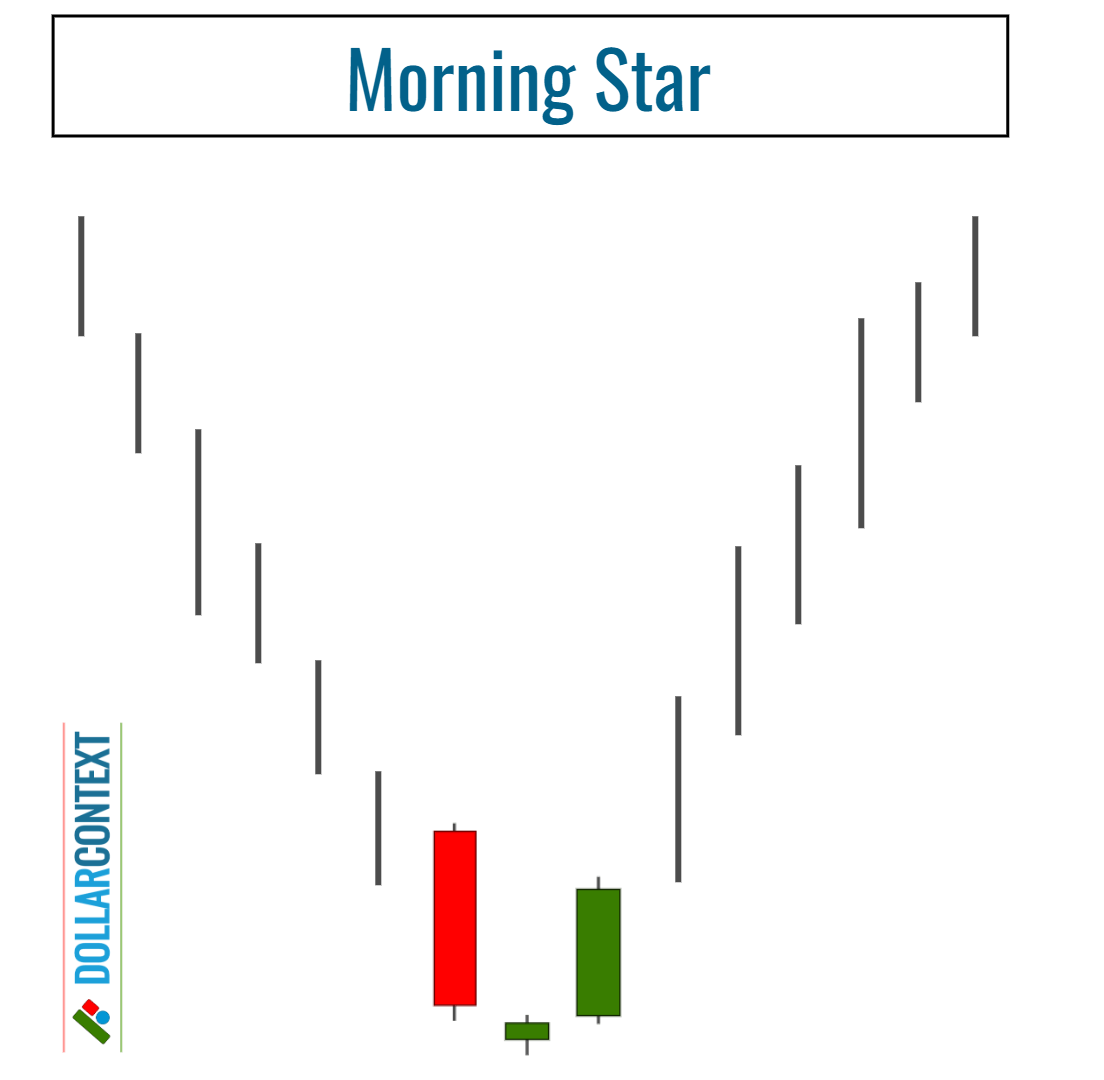

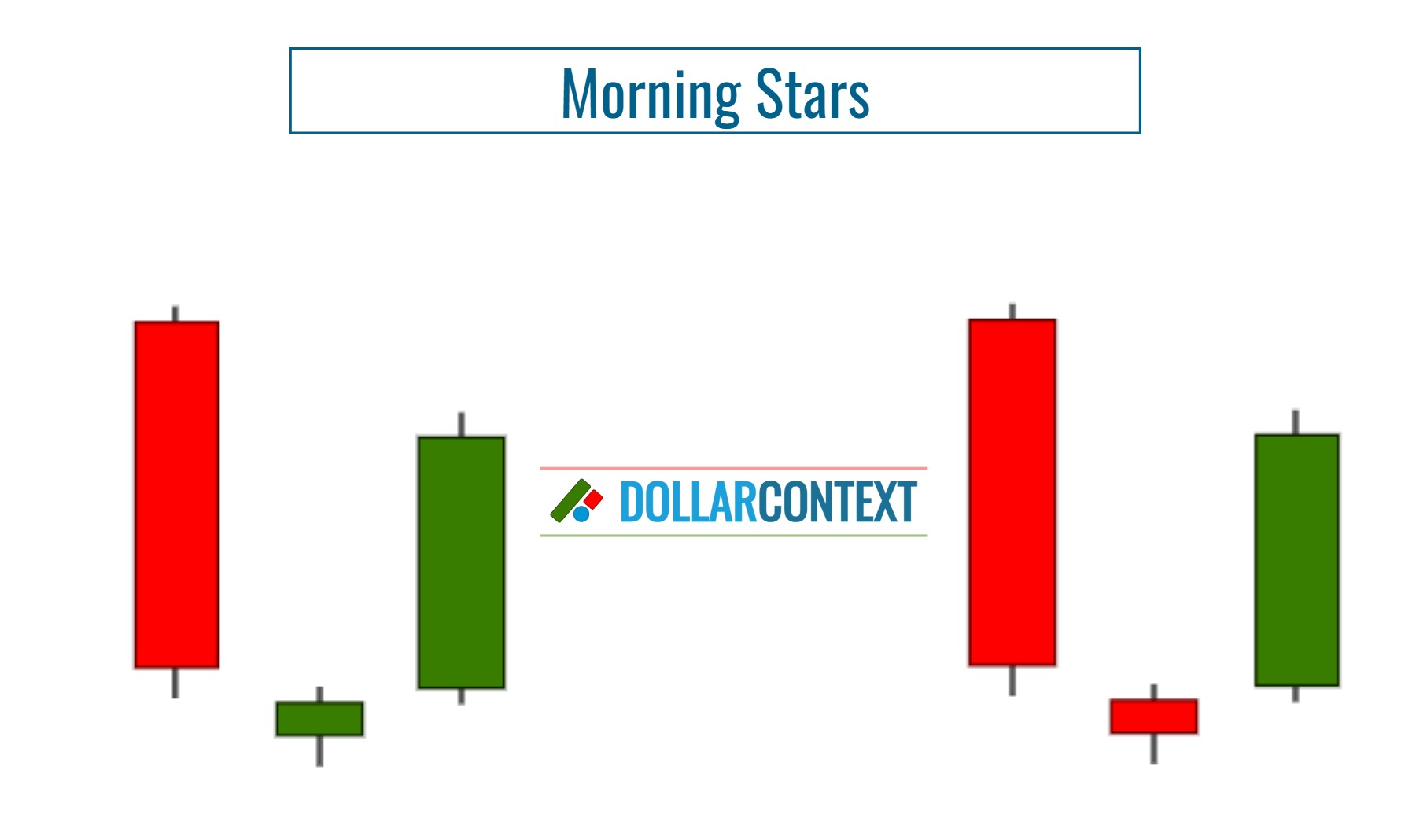

The morning star is a bullish reversal pattern that occurs after a downward price movement.

This three-candle formation features an initial long red candle, followed by a smaller candle that opens lower, and concludes with a long green candlestick that closes significantly within the body of the first candle. It indicates a potential shift in the market from a bearish to a bullish trend.

We can distinguish three main types of morning stars:

- Standard Morning Star

- Morning Doji Star

- Abandoned Baby Bottom

1. Standard Morning Star

The standard morning star pattern is made up of three distinct candlesticks:

- A lengthy red candle, signifying a robust selling interest.

- A candle with a smaller body (green or red) that is positioned lower than the first, indicating a decrease in momentum.

- A long green candle that both opens above the second and closes significantly within the body of the first.

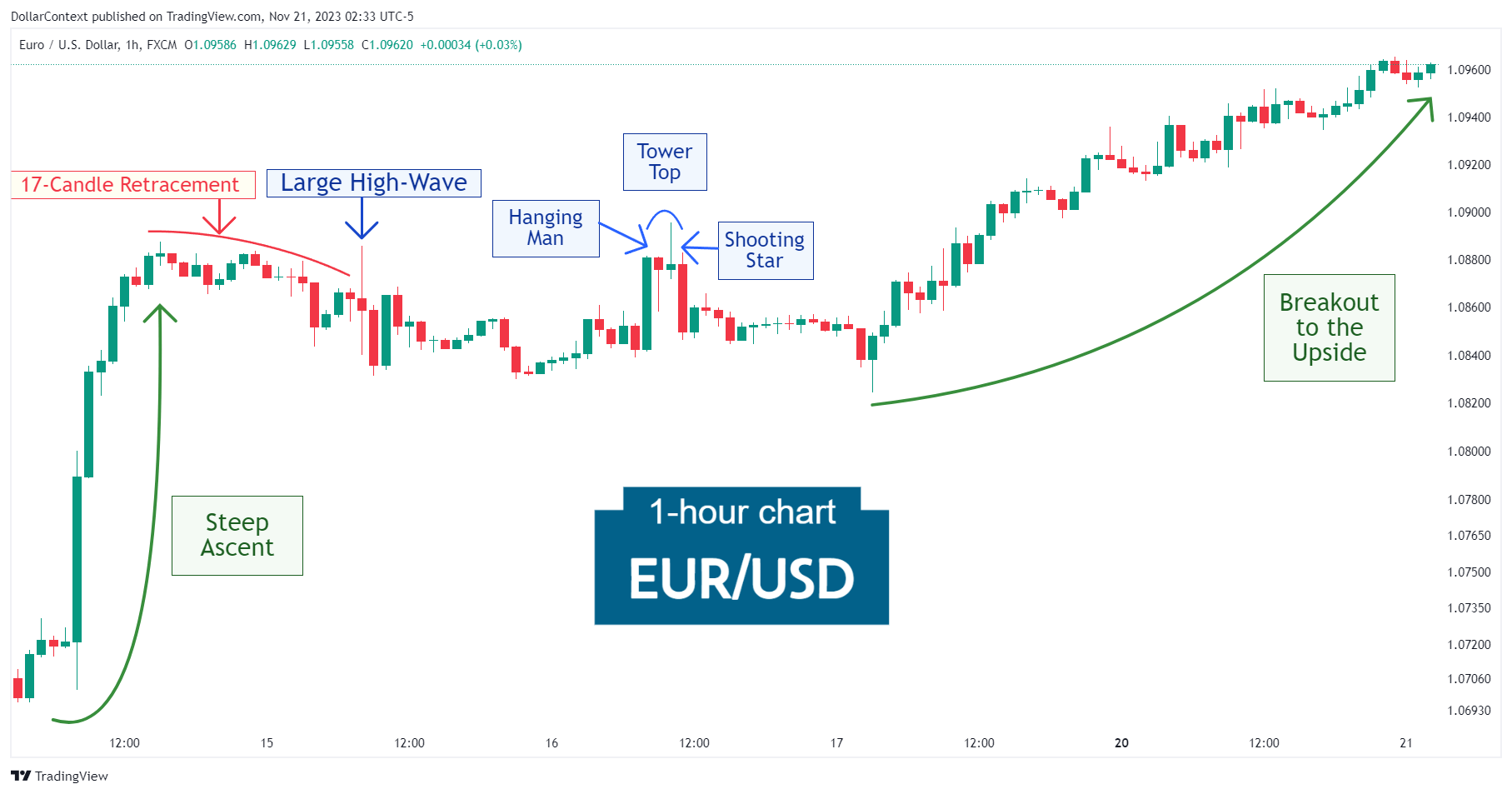

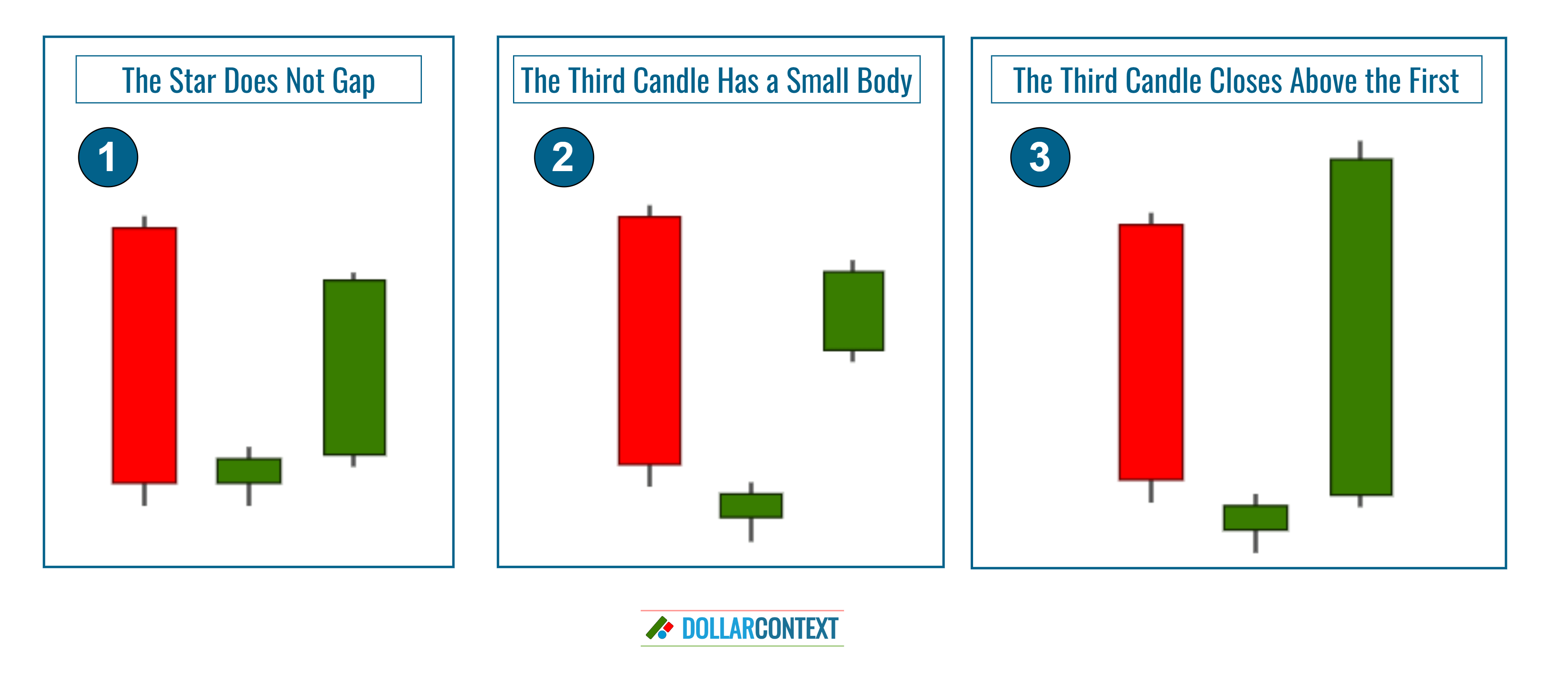

However, real-world instances don't always perfectly align with the perfect version outlined above. Candlestick charting methods, similar to other pattern recognition techniques, offer guidelines rather than rigid rules.

The criteria mentioned earlier describe the ideal or textbook version of this pattern. However, in practical trading, variations of the morning star that don't precisely match this ideal can still be considered valid under particular market conditions.

Here are the most commonly encountered variations of the morning star pattern:

- The Second Candle (Star) Does Not Gap: This often happens in shorter timeframes and in markets characterized by low volatility. In such scenarios, it's generally a prudent approach to wait for further indications of a reversal before commencing a trade.

- The Third Candle Has a Small Green Body: In such instances, make sure that the third candle closes noticeably within the body of the first candle. If that isn't the situation, it might be a good idea to seek additional confirmation before taking any action.

- The Third Candle Closes Above the First: This is a common occurrence in markets that are either well-established or have entered a mature phase. A prominent green candle signals a change in market sentiment, possibly marking the onset of a new bull phase.

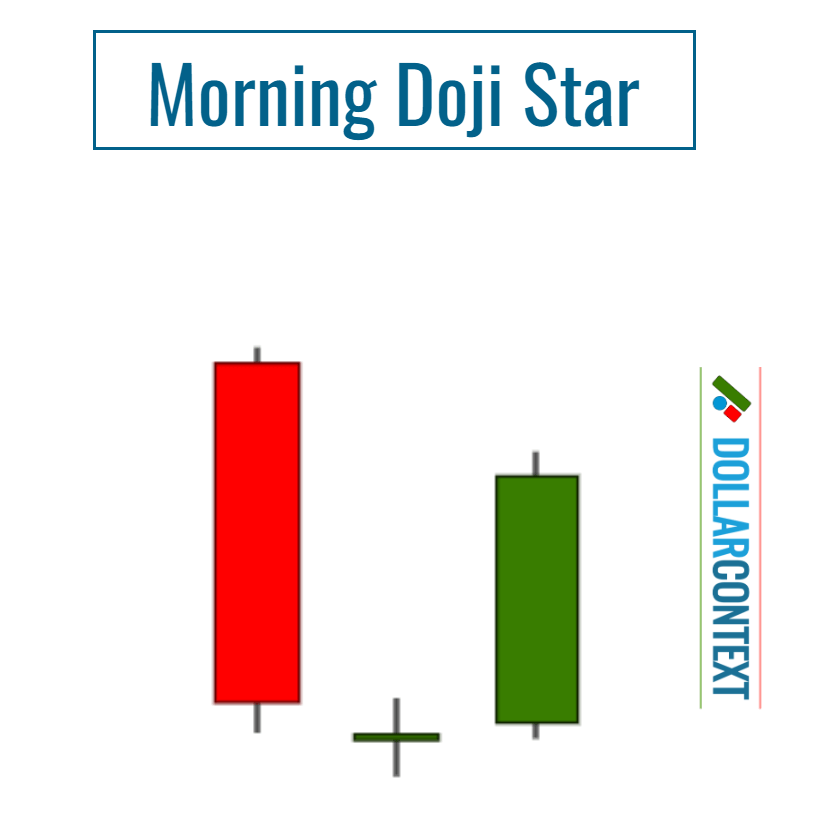

2. Morning Doji Star

The morning doji star is a distinctive form of the standard morning star. While the standard morning star features a small real body for its second candlestick, the morning doji star incorporates a doji in that position. The presence of a doji elevates the importance of this particular pattern.

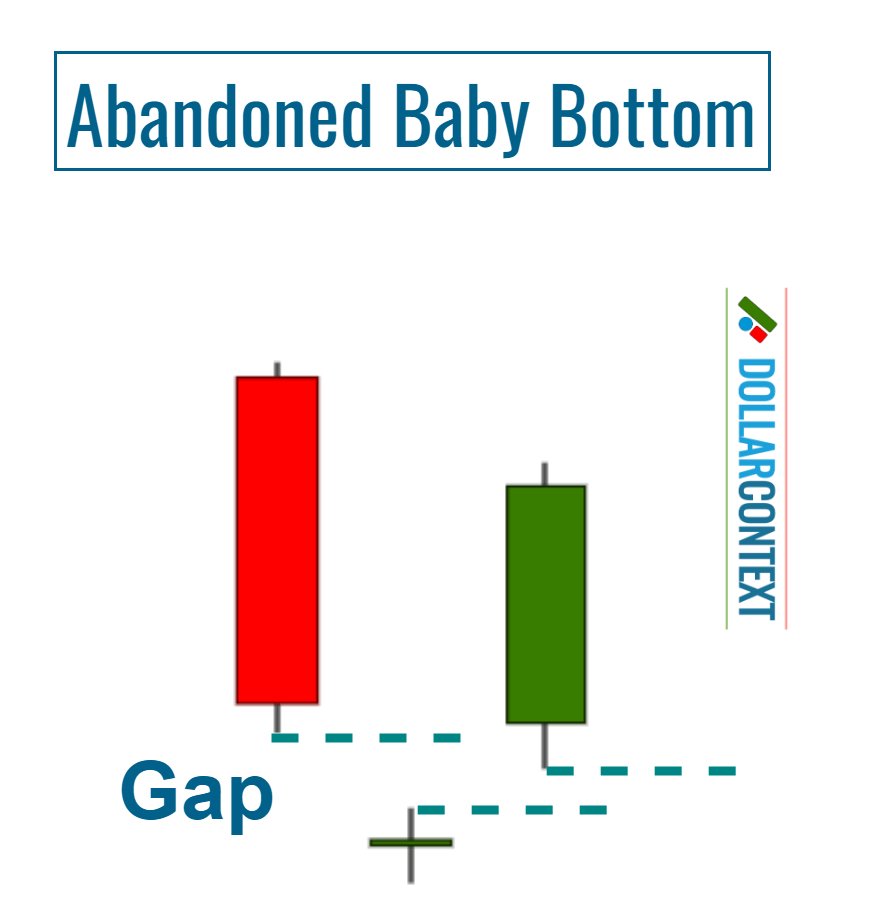

3. Abandoned Baby Bottom

If a doji with a downward gap (meaning the shadows don't overlap) is followed by a green candlestick with an upward gap where the shadows also don't touch, this is recognized as a strong signal for a major bottom reversal. This specific configuration is termed an "abandoned baby bottom," and it is a very rare pattern.