Optimal Entry Points With Piercing Patterns

When a piercing pattern emerges, it signals a potential bullish reversal. Here are different options for entry points after this pattern.

When a piercing pattern emerges, it signals a potential bullish reversal, especially after a downtrend. Here are different options for entry points after the emergence of this pattern:

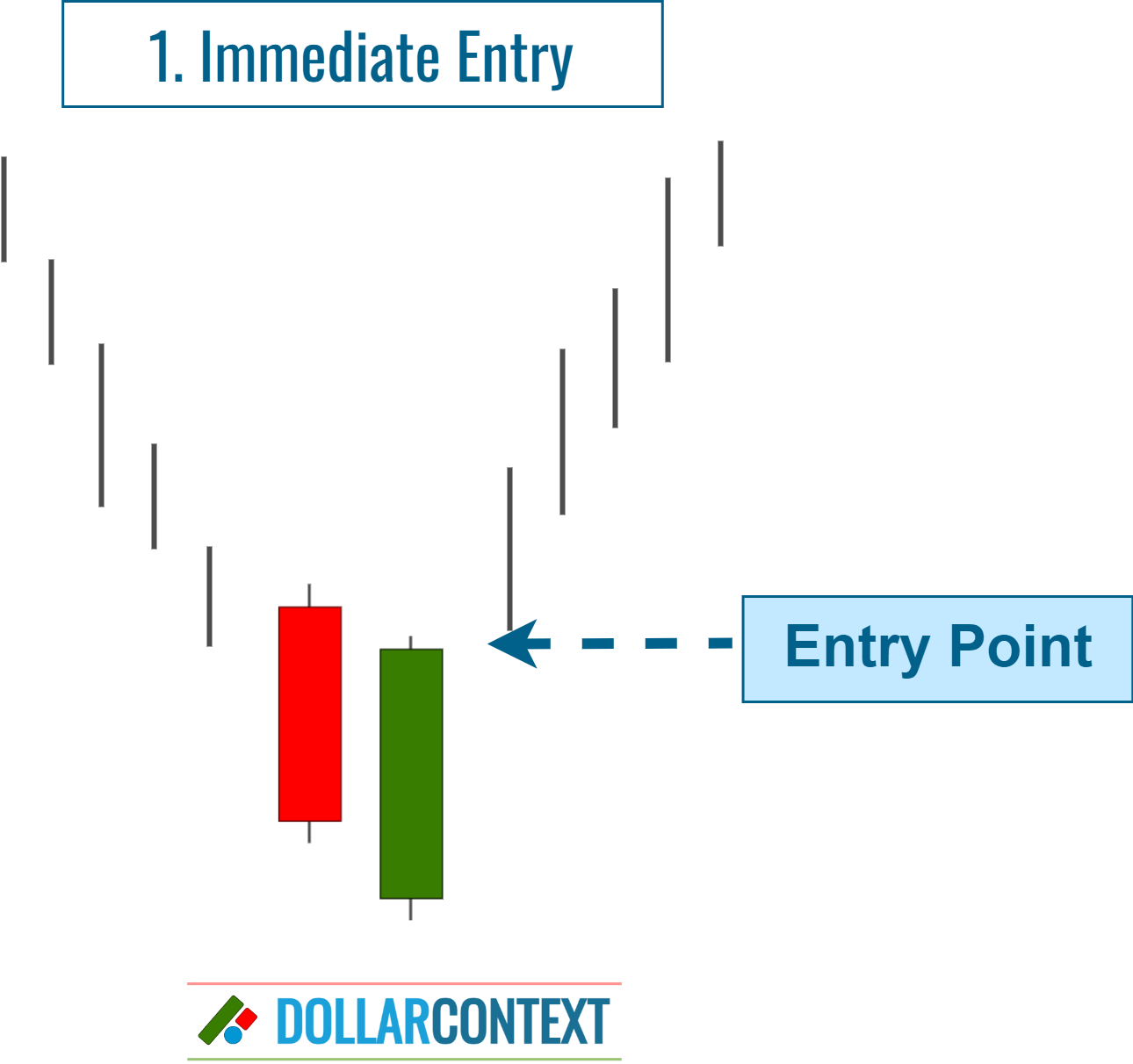

1. Immediate Entry

As soon as the piercing pattern is confirmed (after the close of the second candlestick), an entry can be made. This approach is more aggressive and is based on the anticipation of a continued bullish move.

- Advantages: You don't miss out on the trade.

- Disadvantages: The stop-loss level for your piercing pattern, usually set below its lowest point, could be too distant, potentially diminishing the profit-to-risk ratio. Also, you're initiating a long position without additional verification.

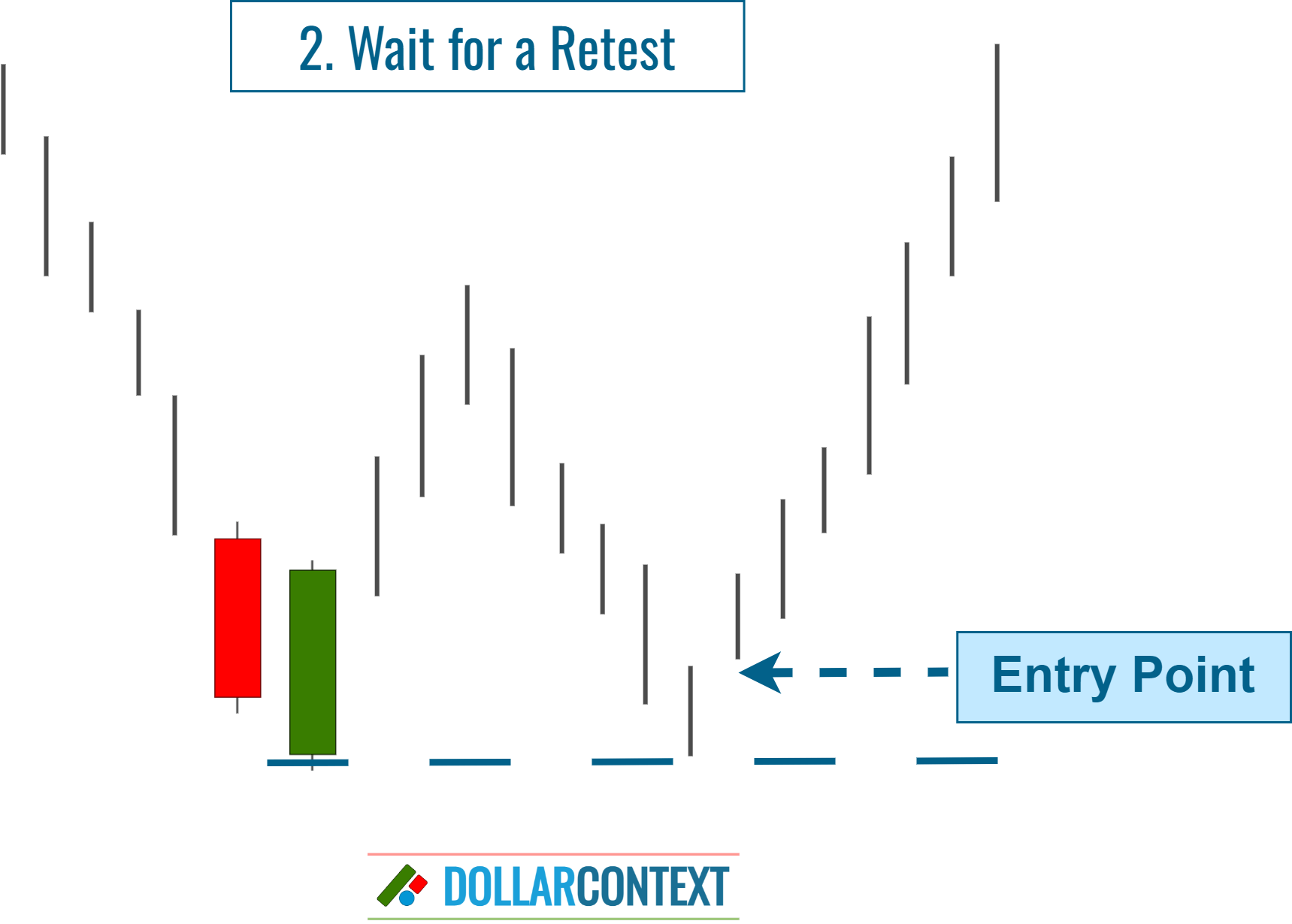

2. Wait for a Retest

Often, after a piercing pattern forms, lingering selling pressure remains. This may lead the market to revisit the lows of the two-candle combination before possibly embarking on an upward trend.

Some traders wait for the price to retest the low of the piercing pattern before entering. This approach ensures that the support level (the low of the pattern) holds.

- Advantages: The profit-to-risk ratio may improve significantly. In addition, a successful re-evaluation of the support level set by the piercing pattern strengthens its potential credibility as a bullish indicator.

- Disadvantages: Given that there are instances where the pattern's lows aren't revisited, you might miss the trading opportunity.

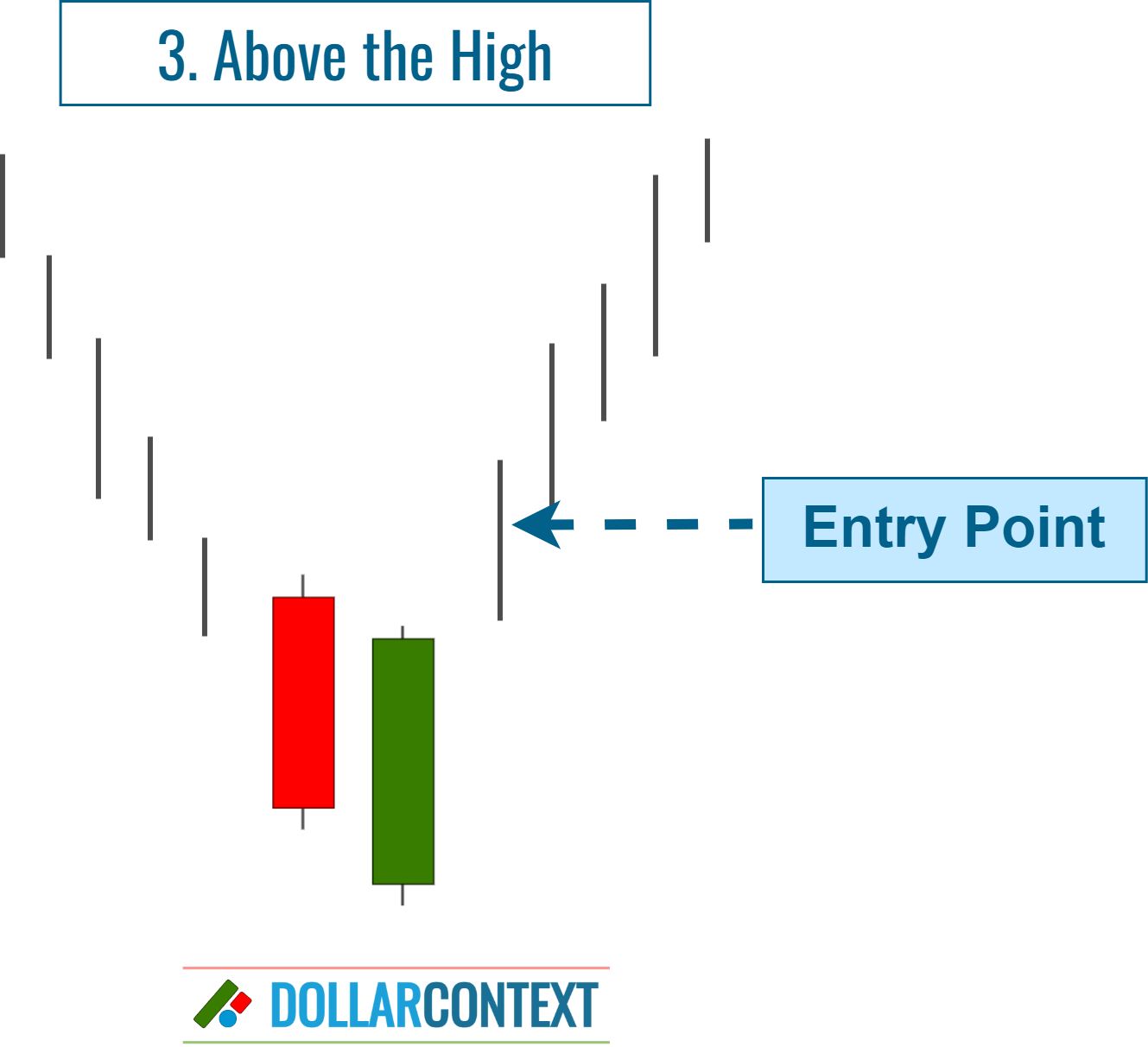

3. Above the High

Enter when the price moves above the high of the second candlestick in the piercing pattern. This approach waits for additional confirmation that the bullish sentiment is strong.

- Advantages: This strategy helps corroborate the legitimacy of the pattern and reduce the probability of being misled by a false indicator.

- Disadvantages: The risk/reward ratio worsens, especially if you decide to buy on a close.

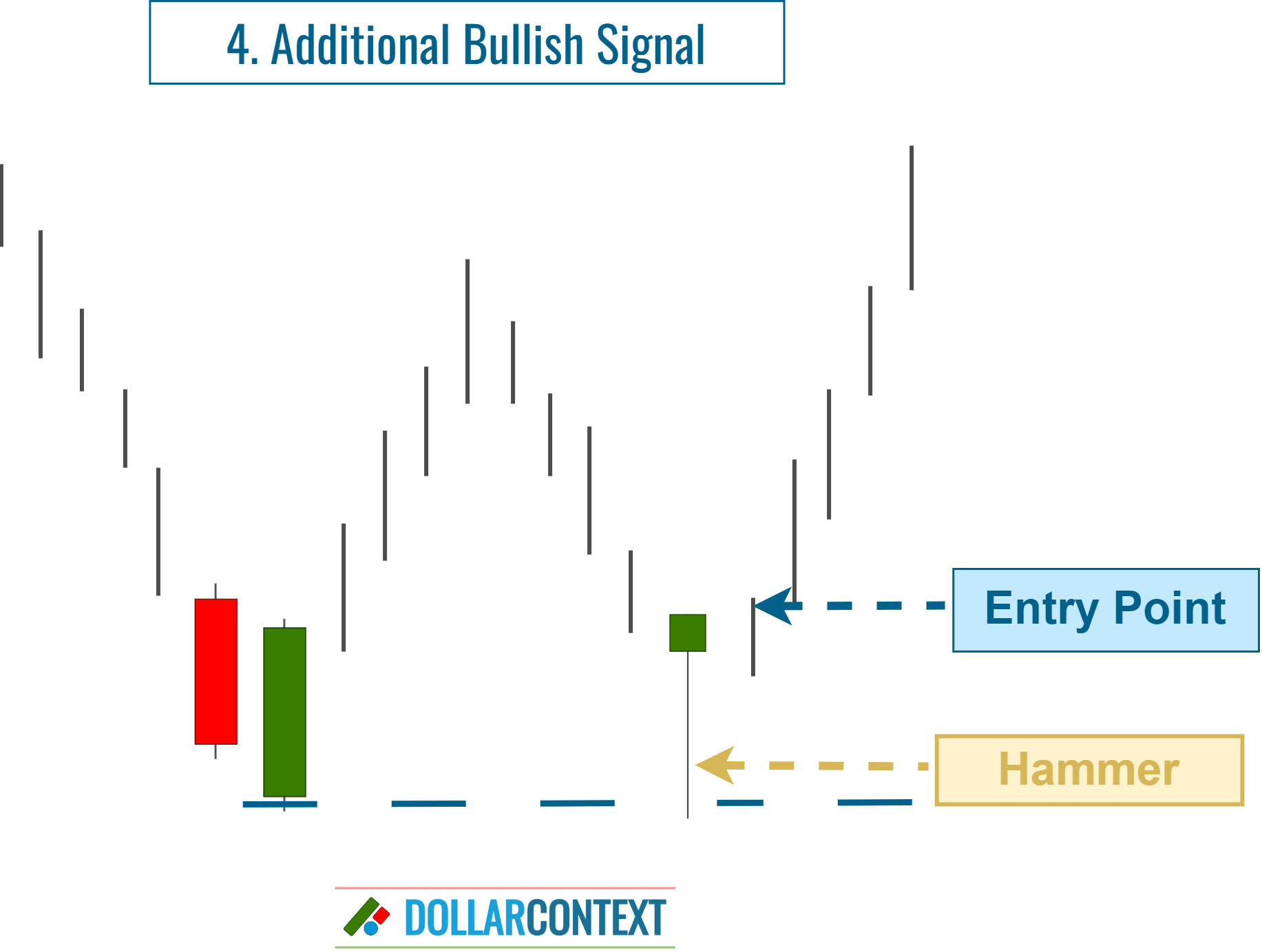

4. On an Additional Bullish Signal

After the piercing pattern, wait for another bullish candlestick pattern or signal before entering. This could be a bullish engulfing pattern, a hammer, a long white real body, a morning star, or another positive sign.

Keep in mind that the additional bullish indicator, which confirms the bullish signal of a piercing pattern, can also come before it.

- Advantages: A bullish signal that comes before or after the piercing pattern amplifies its bullishness and enhances the robustness of the support area set by this pattern.

- Disadvantages: The piercing pattern may not be preceded or followed by another bullish pattern.

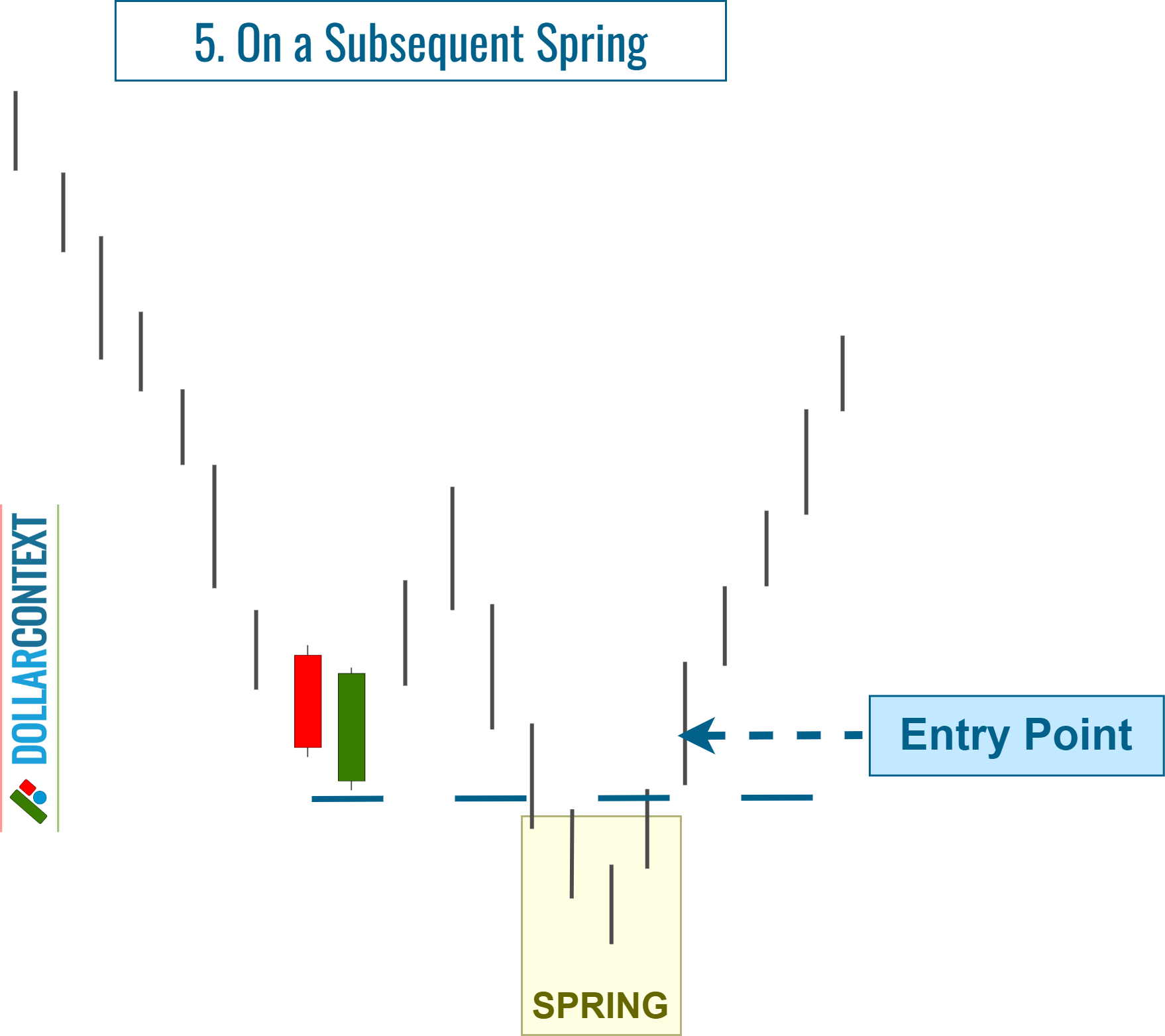

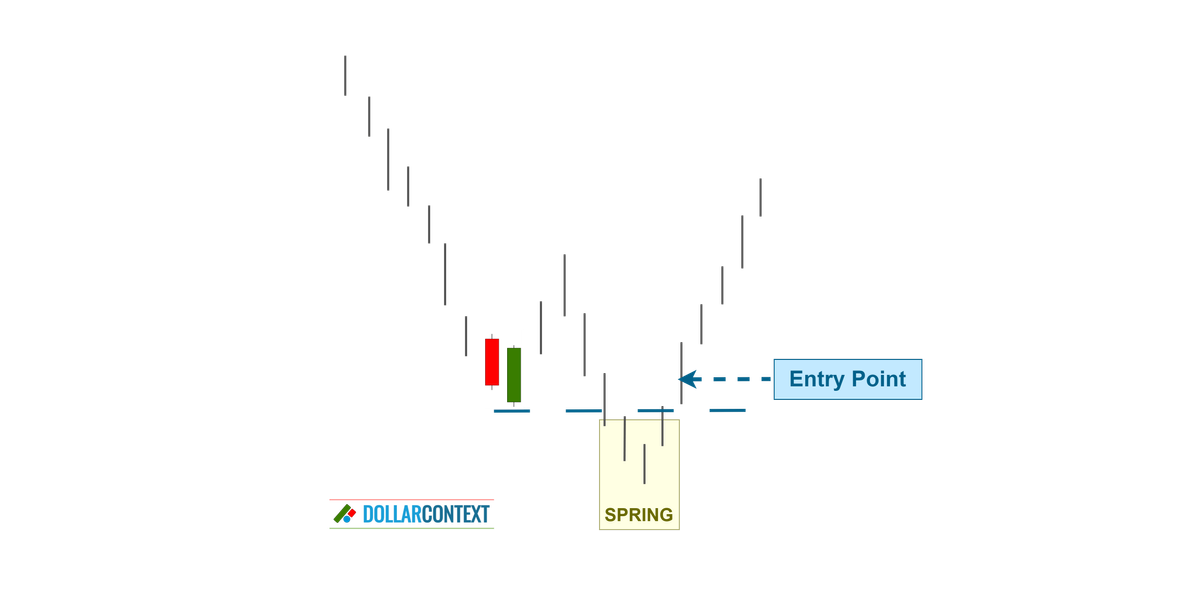

5. After a Spring

A spring is a price action where the market momentarily dips below a support level, only to swiftly reverse and head in the opposite direction. Basically, it's a false breakout to the downside.

A spring signals that even though bears tried to push the price down, they failed to maintain control, and the bulls were able to reclaim dominance, suggesting potential upward momentum.

- Advantages: The likelihood of a bullish reversal following the piercing pattern significantly rises when succeeded by a spring.

- Disadvantages: The new stop should be based on the lows of the spring, making it further from the entry point. Also note that springs don't always materialize. Yet, if one does appear, the piercing strategy with a stop at the spring's lows is usually a sound approach.