Shooting Star: How to Set Your Stop loss

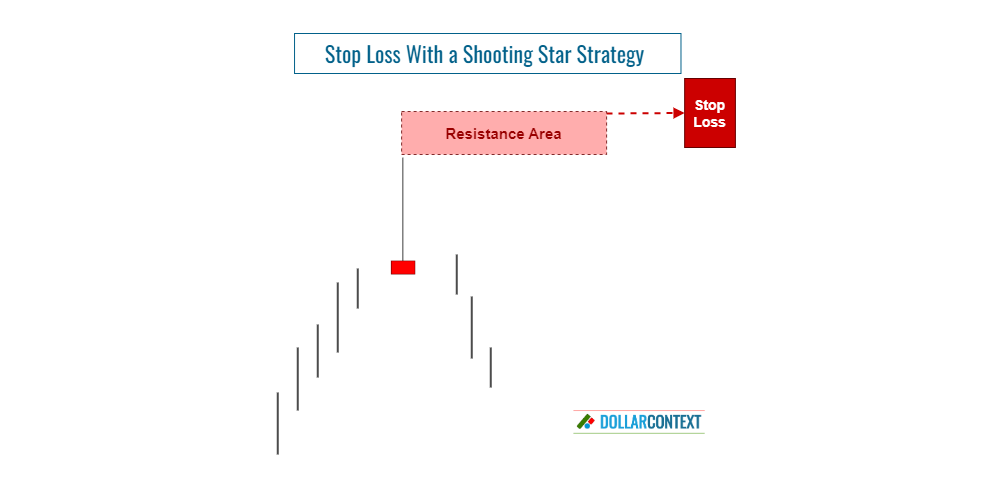

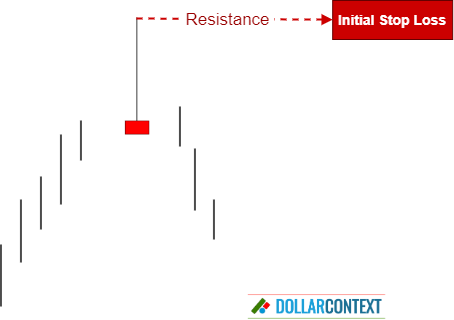

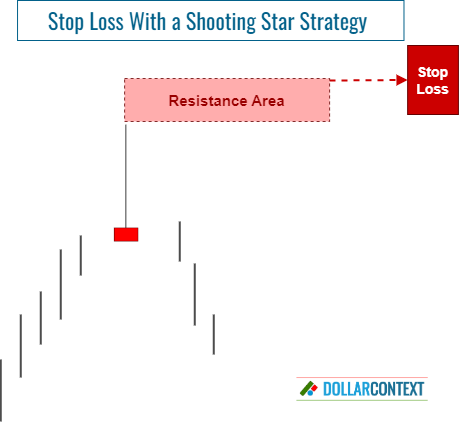

The peak price of a shooting star establishes a resistance level, which functions as your initial stop loss point.

This article is part of the Shooting Star candlestick pattern tutorial series. For the complete guide, see the Shooting Star Candlestick Pattern — Complete Guide.

Candlestick patterns, such as the shooting star, provide crucial clues about the best timing for trade entries. However, to manage risks effectively, it's essential to implement an appropriate stop-loss strategy when using these techniques.

Here are detailed, step-by-step instructions for setting a stop loss following the emergence of a shooting star pattern:

1. Proper Identification

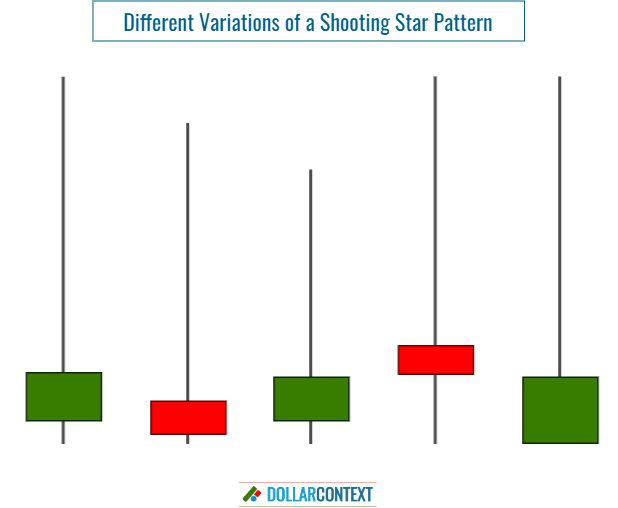

Make sure you correctly identify the shooting star pattern on your trading chart. This pattern is characterized by:

- a small real body at the lower end of the candle line,

- a protracted upper shadow, and

- a very short (or nonexistent) lower shadow.

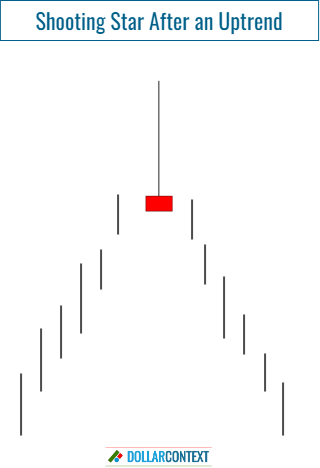

2. Verify the Prior Trend

Psychologically, a shooting star conveys a shift in market sentiment. The market transitions from a bull to a bear trend, and as a reversal indicator, it requires a previous upward trend to reverse.

If the market is either trading sideways or experiencing a decline, a shooting star usually carries no significance.

3. Identify the Resistance Level

The peak price of a shooting star establishes a resistance level, which functions as your initial stop loss point.

4. Consider Adding a Safety Margin

After assessing elements such as market volatility, risk management approaches, and other market conditions, you may need to add a buffer to your initial stop-loss level. This additional safeguard can effectively protect you from the impact of false breakouts.

5. Is Your Stop Based on the Close?

A stop activated upon closing occurs when the final price of a session surpasses the stop-loss limit, rather than simply relying on intra-session price fluctuations.

Typically, it's advised to set a stop at a close with candlestick charts, particularly when using a shooting start pattern to open your position.

6. Monitor the Trade

Keep monitoring the market and your position to guarantee alignment with your candlestick trading strategy:

- Adjust your stop-loss level as necessary. Market circumstances are highly dynamic. New candlestick patterns might appear as your trade progresses. In these instances, you might need to slightly adjust your stop-loss level to stay in sync with the new circumstances. For example, if a new candlestick pattern emerges approximately at the same level as your shooting star, you should recalibrate your stop to the peak point of both patterns.

- In the case of favorable price movements, think about applying a trailing stop-loss to protect profits and manage risk.

- Stay disciplined. Avoid decisions driven by emotion, even in the face of market turbulence.