Types of Evening Star Patterns

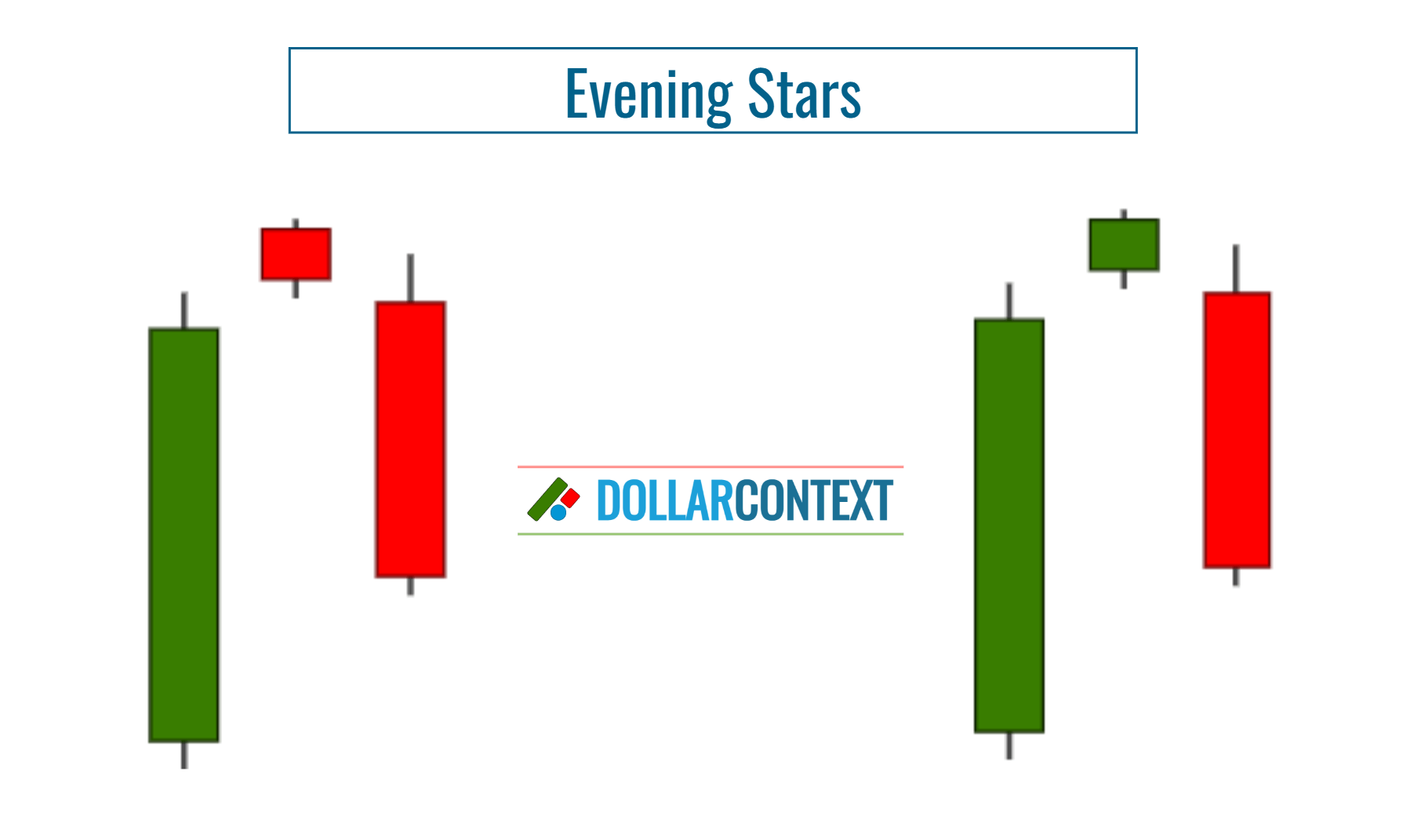

We can distinguish three primary types of evening stars: standard evening star, evening doji star, and abandoned baby top.

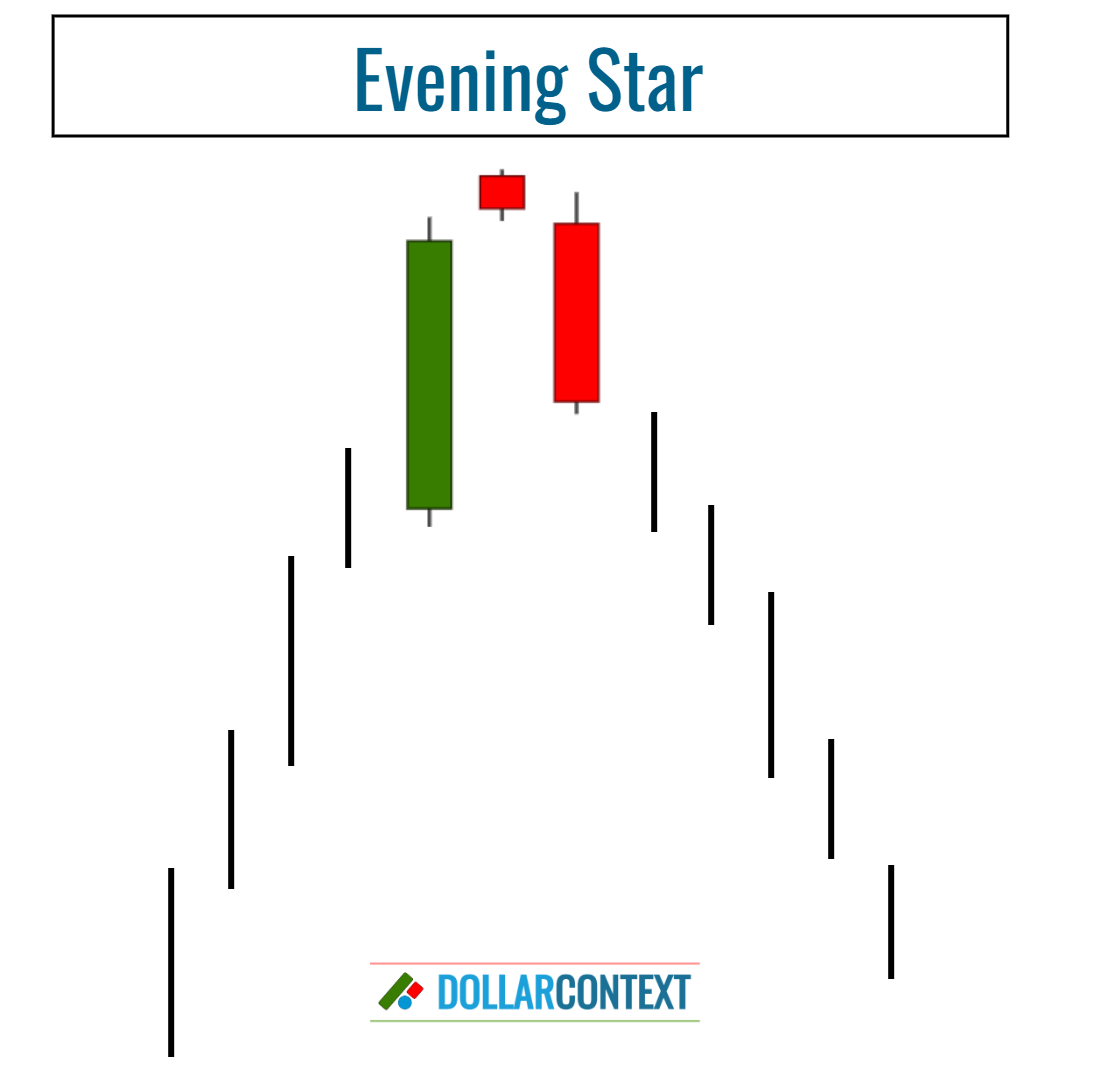

The evening star is a bearish reversal pattern that occurs after an upward price movement.

This three-candle pattern features an initial long green candle, followed by a smaller candle that opens higher, and concludes with a long red candle that closes significantly within the body of the first candle. It suggests a potential shift in the market from a bullish to a bearish trend.

We can distinguish three key types of evening stars:

- Standard Evening Star

- Evening Doji Star

- Abandoned Baby Top

1. Standard Evening Star

The standard evening star pattern is made up of three distinct candlesticks:

- A lengthy green candle, signifying a robust buying interest.

- A candle with a smaller body that is positioned higher than the first, indicating a decrease in momentum.

- A long red candle that both opens beneath the second and closes significantly within the body of the first.

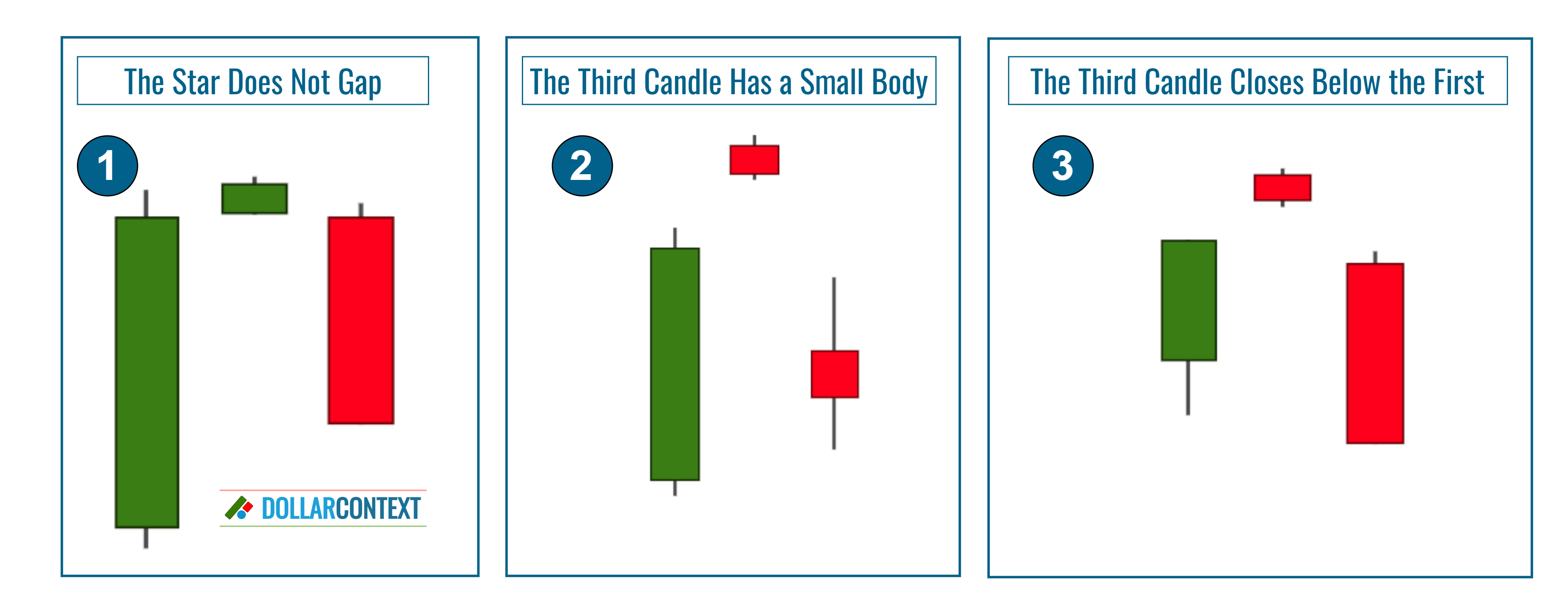

However, real-world instances don't always perfectly align with the idealized version outlined above. Candlestick charting methods, much like other pattern recognition techniques, come with guidelines rather than strict rules.

The criteria mentioned above describe the textbook or ideal form of this pattern. However, in practical trading, variations of an evening star that don't exactly match this ideal can still be considered valid under specific market conditions.

Here are the most frequently encountered variations of the evening star pattern:

- The Second Candle (Star) Does Not Gap: This occurs frequently in shorter timeframes and markets with low volatility. In these situations, it's often advisable to wait for additional signs of a downward trend before initiating a trade.

- The Third Candle Has a Small Black or Red Body: In such cases, ensure that the third candle closes significantly within the first candle's body. If that's not the case, it may be wise to look for further confirmation before making a move.

- The Third Candle Closes Below the First: This is frequently observed in markets that are either well-established or have reached a mature phase. A prominent red candle signals a change in market sentiment, possibly marking the onset of a new bear phase.

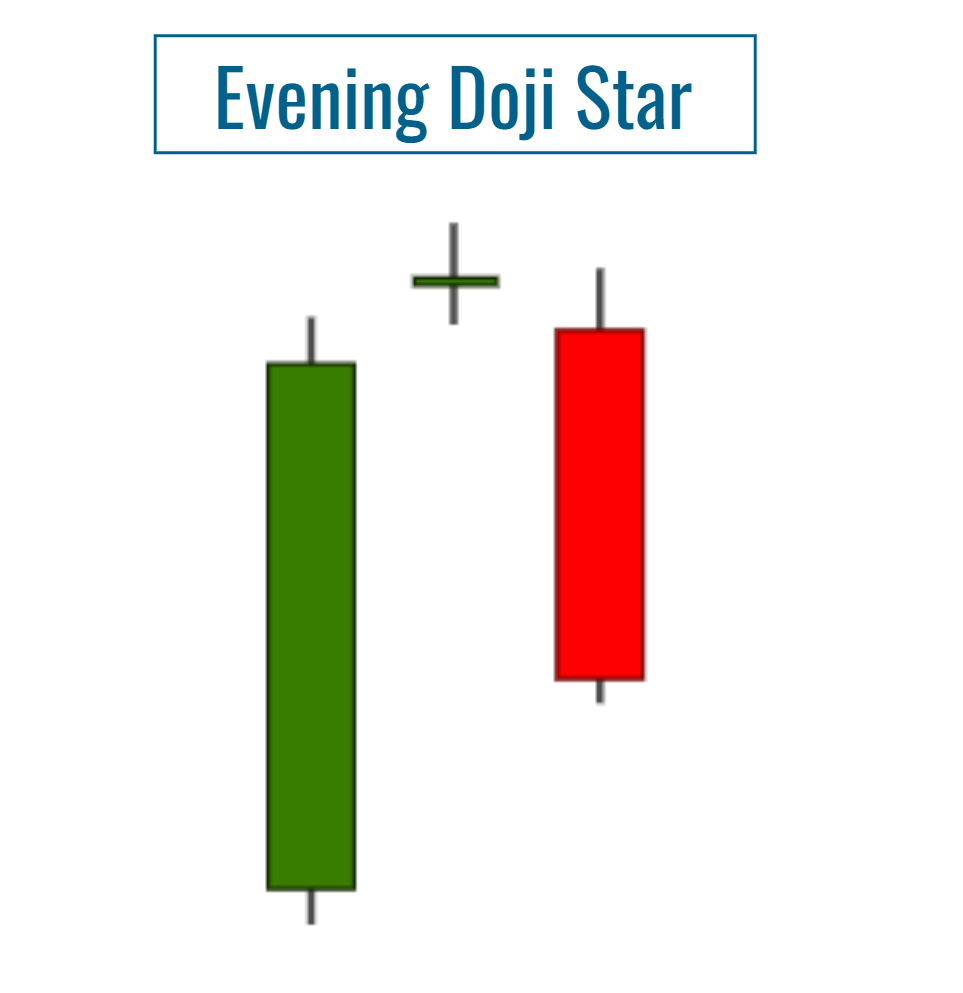

2. Evening Doji Star

The evening doji star is a distinctive form of the standard evening star. While the standard evening star features a small real body for its second candlestick, the evening doji star incorporates a doji in that position. The presence of a doji elevates the significance of this particular pattern.

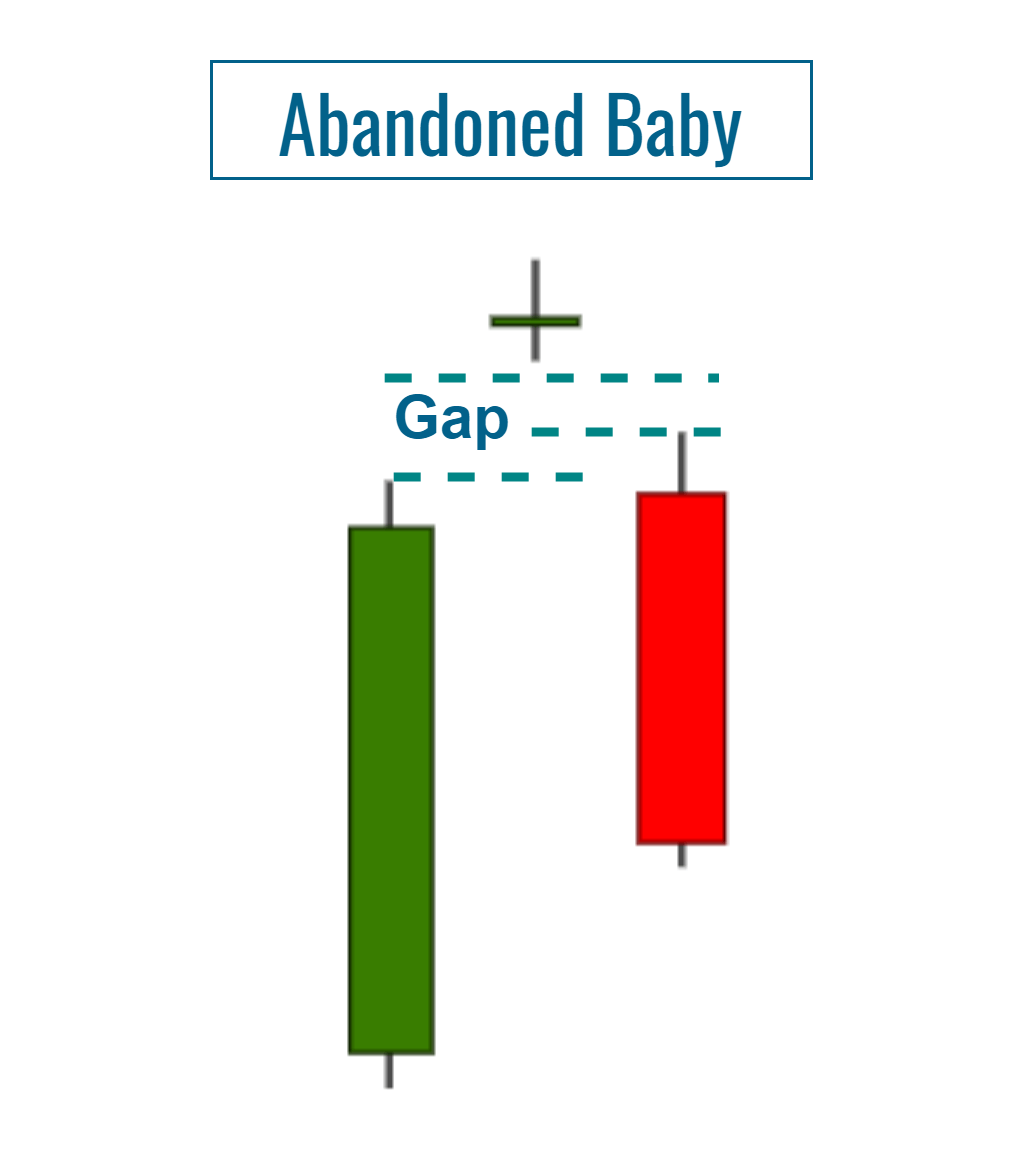

3. Abandoned Baby Top

If a doji with an upward gap (meaning the shadows don't overlap) is followed by a red candlestick with a downward gap where the shadows also don't touch, this is recognized as a strong signal for a major top reversal. This specific configuration is termed an "abandoned baby top," and it is a very rare pattern.