Trading Strategies With Springs

Using a spring strategy can be extremely effective if you can recognazize these signals and know how to leverage them to your advantage.

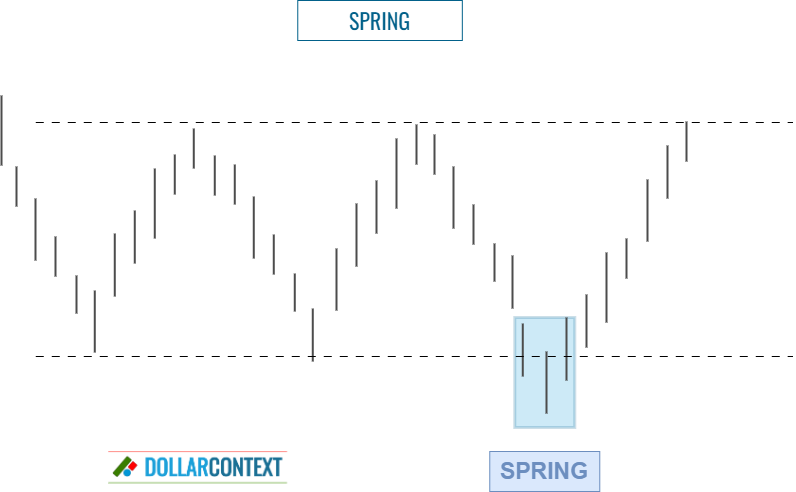

A spring is a pattern where the asset's price briefly moves below a key support level before quickly rebounding, often indicating a potential bullish reversal. This price action is quite frequent and typically traps traders who opened a short position into the breakout, expecting the price to continue its downward trajectory.

Implementing a spring-based strategy can yield significant results if you are adept enough to identify those signals and know how to use them to your advantage.

Contents

1. Early Identification of a Spring

Can you verify the authenticity of a spring in real-time? Unfortunately, that's not possible; only in hindsight, once the pattern has concluded, can it be conclusively identified as a "spring."

However, by considering these factors, you can validate the "credibility of a spring" in a timely manner:

- Market Context: Does the spring surface within a well-established trading range? The significance and dependability of a spring could be heightened if it takes place within a clearly defined trading range or consolidation pattern.

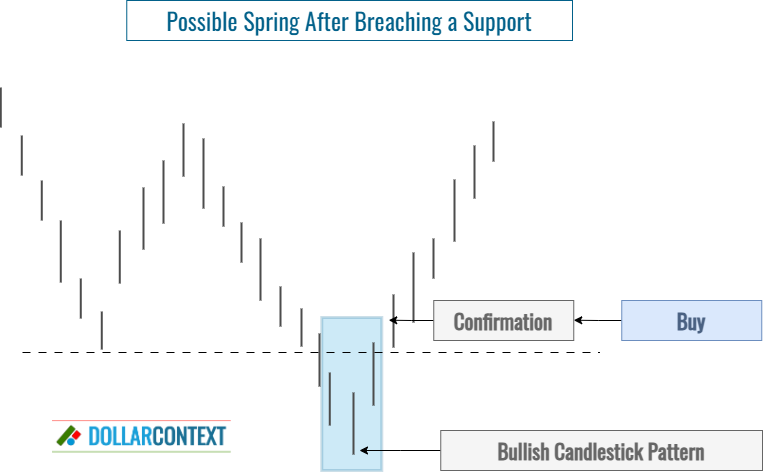

- Additional Bullish Signs: You can integrate different technical instruments to assess the credibility of a spring. For instance, if the candlesticks forming a potential spring portray a bearish candlestick pattern, like a piercing pattern, a hammer, or a morning star, the likelihood of it being an authentic spring substantially rises.

- Moving Back into the Trading Range: If the price returns to the trading range, there's a probability that a spring pattern is in progress. Nevertheless, exercise caution regarding minor breaches into the range, as the price might persist in its downward path instead of rising.

- Volume Confirmation: A spring has the potential to be a misleading indication. In such instances, the volume on the day of the spring might be comparatively low, suggesting a lack of strong commitment to the buying pressure. If the price returns marginally above the support level but subsequently declines while accompanied by rising volume, this could imply that the presumed spring was not a dependable bullish signal.

- Follow-through: Keep in consideration that springs can manifest in a multitude of manners. For instance, the price might hover close to the support/resistance level prior to re-entering the trading range. Alternatively, it could even test the lows established by the spring before confirming the upward movement.

This example illustrates the importance of noticing a candlestick pattern and employing it as a validating signal once a potential spring is recognized. In this case, a morning star pattern breached the support level, then quickly re-entered the trading range to initiate a brief rally.

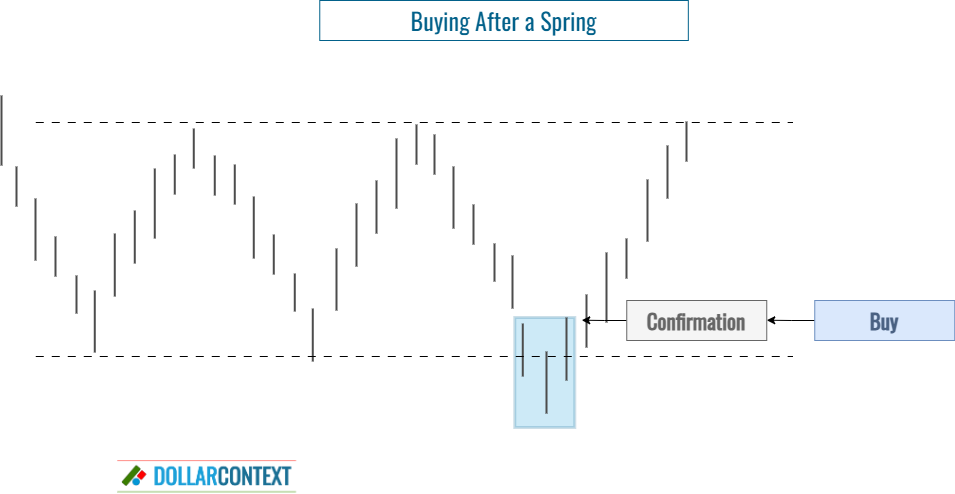

2. When to Enter a Trade

Springs can provide fantastic prospects for initiating long positions. However, as mentioned earlier, securing confirmation signals is crucial to avoid deceptive cues. On the flip side, excessively waiting for confirmation might lead to buying at a significantly higher level, impacting negatively our risk-to-reward ratio.

In other words, we must find a middle ground between:

- Obtaining sufficient confirmation to ensure a high probability of a spring being authentic.

- Taking swift action to optimize the profit-to-risk ratio in our favor.

When deciding whether to open a long position after the emergence of a potential spring pattern, we need to differentiate between two distinct scenarios:

In the event of a sideways market trend, it's strongly advisable to hold off until the price re-enters the trading range. How deep into the trading range should the price extend to qualify as a credible confirmation? To address this question, we should evaluate whether the potential spring is accompanied by additional technical indicators, like a candlestick pattern, that can support its reliability.

When the market exhibits an initial breakout from a pre-established support level, bear in mind that depending solely on basic upward movements can be misleading. The market might be displaying lower highs and lower lows instead of an authentic spring. In such situations, it becomes crucial to employ alternative technical indicators to validate the spring pattern.

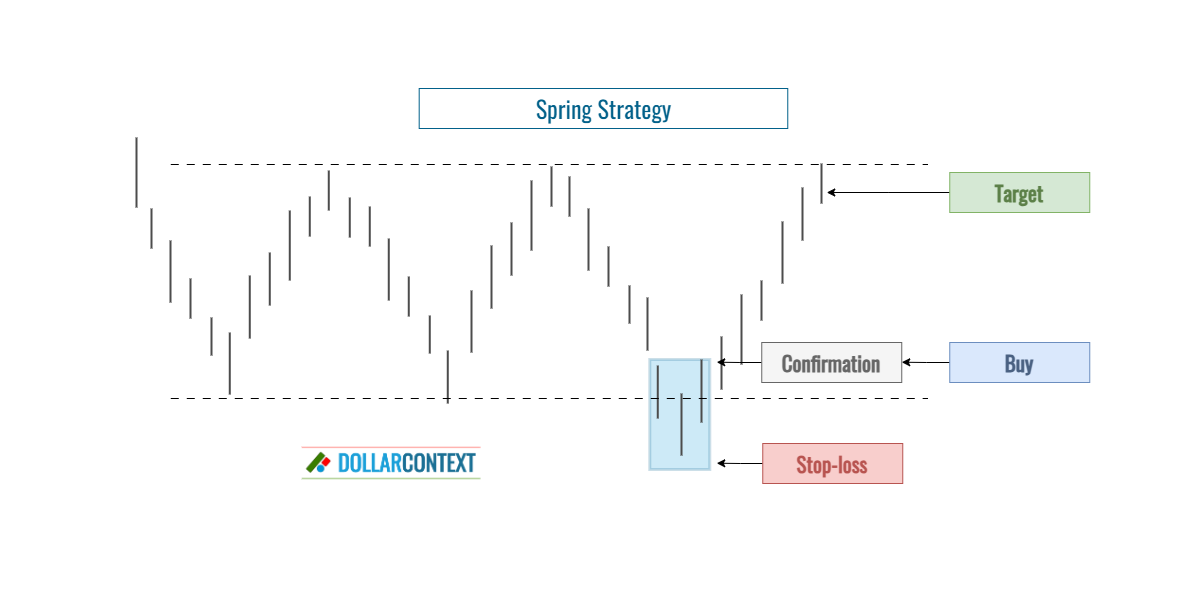

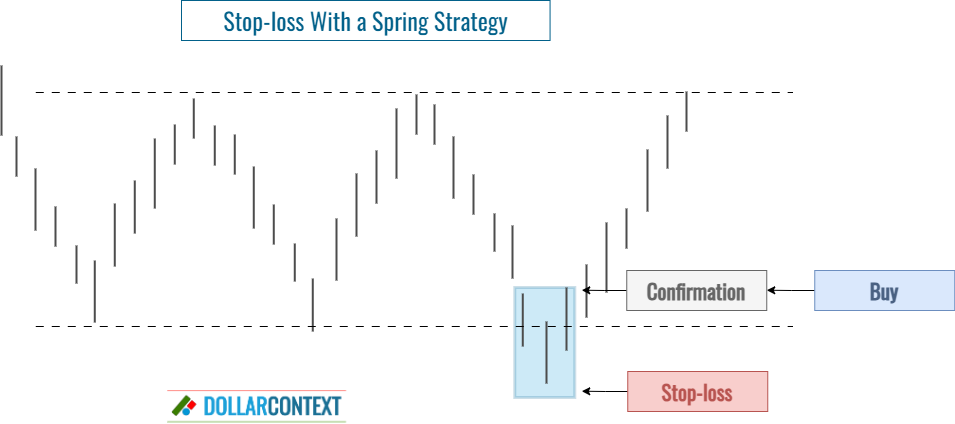

3. Setting Your Stop-loss

An important advantage of the spring strategy is that, when executed correctly, it provides a clear protective stop: the fresh low established by the false breakout.

You might want to consider adding a buffer to prevent getting stopped out due to market volatility.

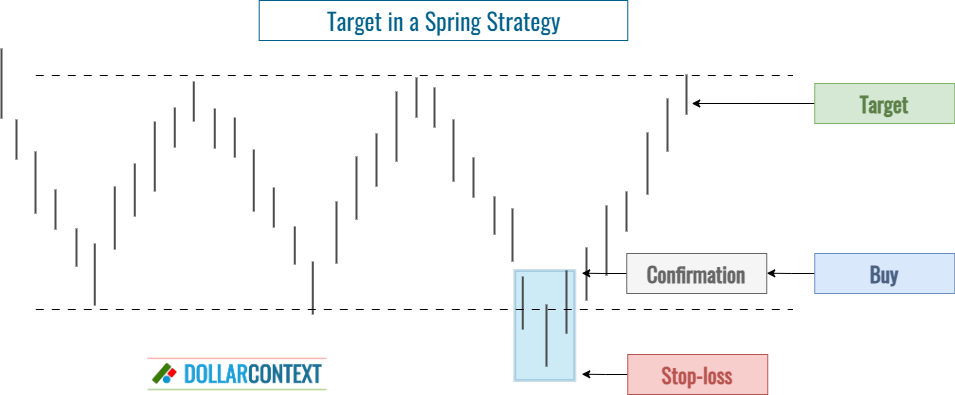

4. How to Set Your Target

If the spring emerges within a horizontal range, it's advisable to place the target near the upper limit of the range. However, exercise caution as setting the target too close to the upper boundary of the trading range could potentially result in it not being hit.

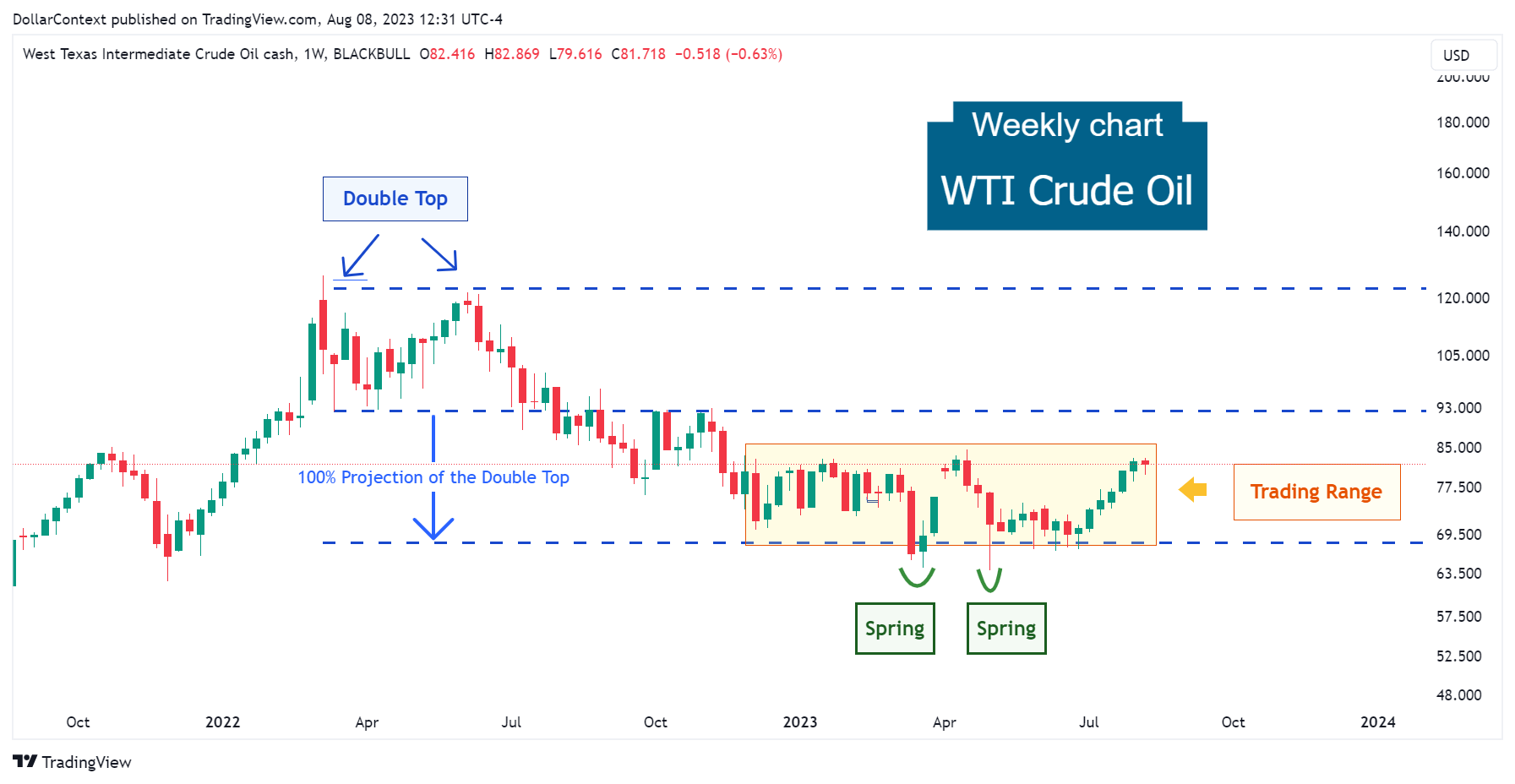

The following chart of crude oil displays two springs in the course of a trading range. Note how both of them reached the target close to the upper boundary of the range.

If the spring merely surfaces in reference to a previously defined support zone, the first objective could be the next resistance level above the one where the spring began. Alternatively, you can resort to other technical indicators to determine the target of your trade.

5. Conclusion

In a market characterized by a trading range, springs can emerge as potent trading instruments, providing a clear objective (the opposite boundary of the trading range) and a safeguard (the recent low formed during the spring).

Beyond periods of lateral market action, employing a spring strategy retains its considerable advantages. However, additional tools might be necessary to validate the pattern or establish appropriate targets.