Trading Strategies With Upthrusts

Using an upthrust strategy can be extremely effective if you are skillful enough to recognazize these signals and know how to leverage them to your advantage.

An upthrust is a price movement where the value of an asset momentarily surpasses a predefined trading range or a significant resistance level, but then quickly reverses to close below that level. This price action is quite common and usually traps traders who opened a long position into the breakout, expecting the price to continue its upward course.

Using an upthrust strategy can be extremely effective if you are skillful enough to recognize these signals and know how to leverage them to your advantage.

Contents

1. Early Identification of an Upthrust

Can you confirm the authenticity of an upthrust in real-time? Unfortunately not. Only in retrospect, after the pattern has completed, can you definitively label it an "upthrust".

However, by considering the following factors, you can recognize a legitimate upthrust early enough.

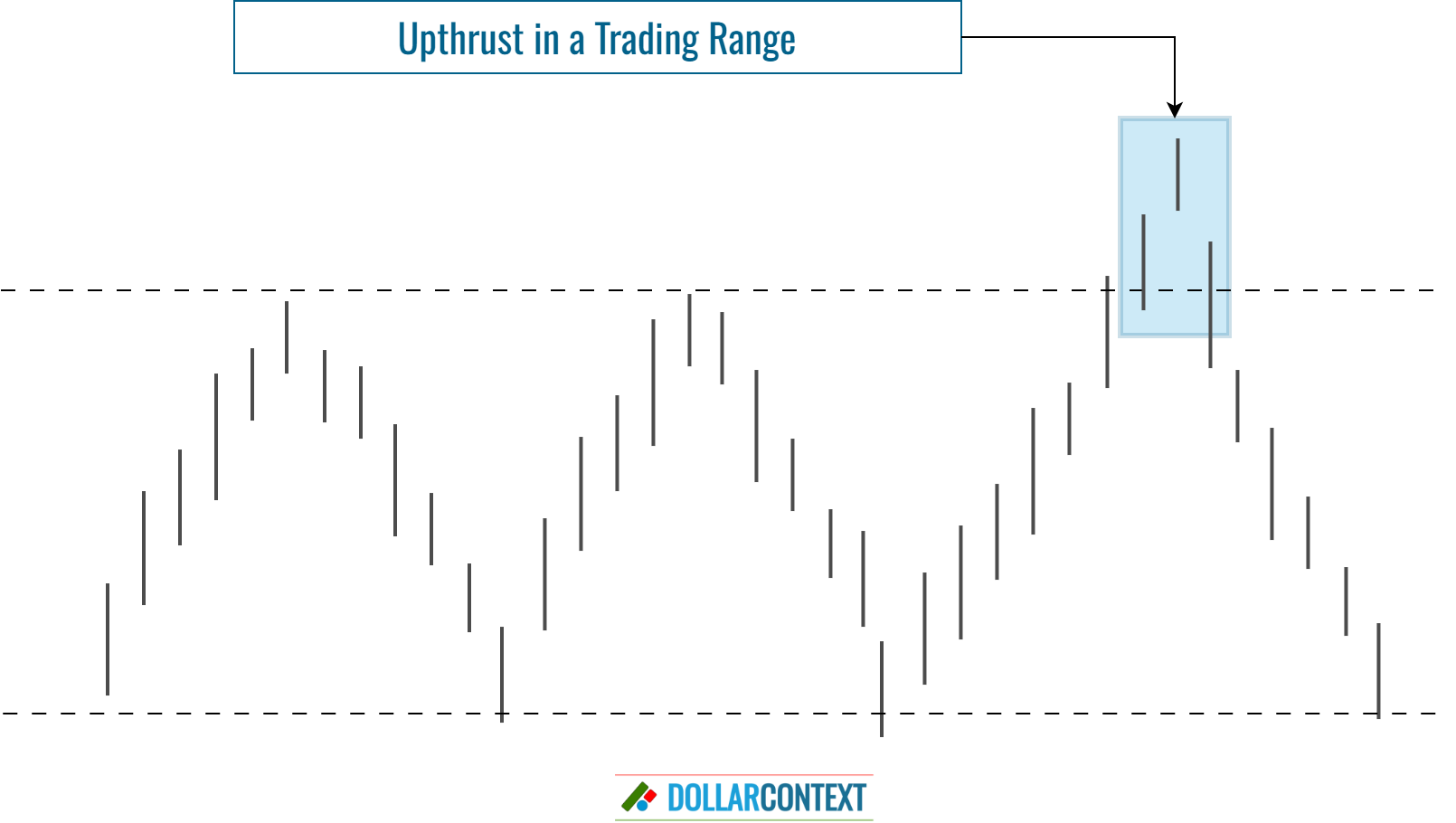

- Market Context: Is the upthrust emerging in an established trading range? The relevance and reliability of an upthrust might be enhanced if it occurs within a well-defined trading range or consolidation pattern.

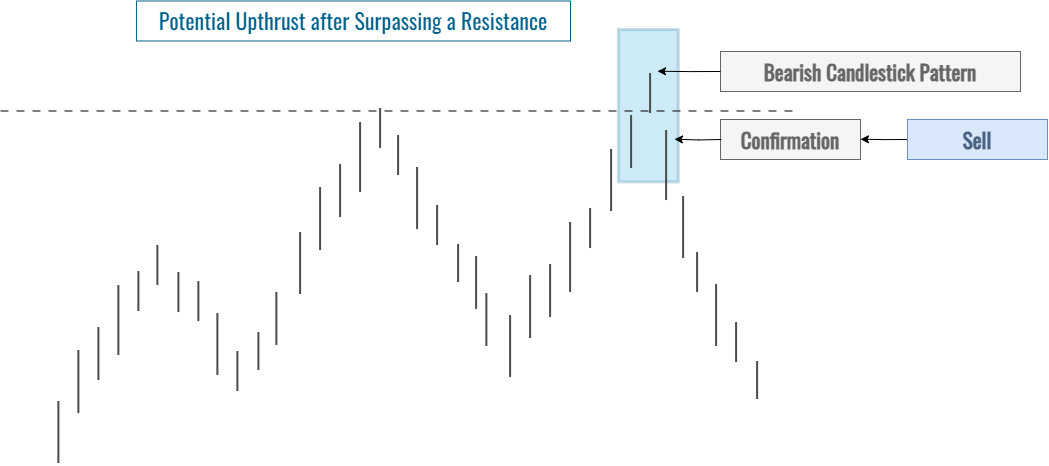

- Further Bearish Signals: You can combine other technical tools to evaluate the likelihood of an upthrust being authentic. For example, if the candles forming a potential upthrust represent a bearish candlestick pattern, such as a dark cloud cover, a shooting star, or an evening star, the probability of being a legit upthrust increases considerably.

- Moving Back into the Trading Range: If the price returns to the trading range, it's likely that an upthrust pattern is unfolding. However, be mindful of slight breaches into the trading range, as the price could continue its upward trajectory rather than dropping.

- Volume Confirmation: An upthrust can be a false signal. In these cases, the volume on the day of the upthrust might be relatively low, indicating that there wasn't a strong conviction in the selling pressure. If the price moves back above the resistance and continues upwards with increasing volume, it could mean the upthrust was not a reliable bearish signal.

- Follow-through: Be patient and bear in mind that upthrusts may unfold in countless ways. For example, the price may linger near the support/resistance level before reentering the trading range. It can also test the highs set by the upthrust before confirming the decline.

This example underscores the significance of considering a candlestick pattern as a validating signal once a potential upthrust is spotted. In this case, a dark cloud cover pattern (marked by the number "3" on the chart) briefly exceeds the resistance level, then quickly retreats back into the trading range, leading to a notable drop.

2. When to Enter a Trade

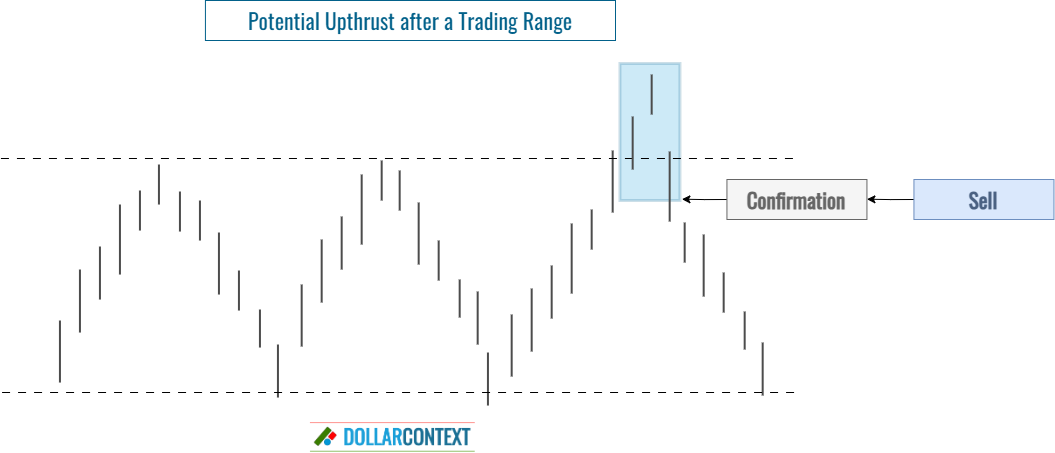

Upthrusts can offer excellent opportunities for short selling. Yet, as previously noted, obtaining confirmation signals is vital to sidestep misleading cues. Conversely, waiting excessively for confirmation could result in selling at a much lower point, adversely affecting our profit-to-risk ratio.

In short, we need to strike a balance between:

- Seeking sufficient confirmation to ensure a high probability of authenticity in a potential upthrust.

- Acting promptly to optimize our profit-to-risk ratio in our favor.

When opening a short position after a potential upthrust pattern, we should distinguish two different situations.

If the market presents a sideways trend, it's highly recommendable to wait until the price returns to the trading range. How far should the price penetrate the trading range to be considered a credible confirmation? To answer this question, we should determine whether the potential upthrust is accompanied by additional technical indicators that can corroborate its reliability.

If the market merely shows an initial breakout from a previously set resistance level, keep in mind that relying uniquely on simple retracements can be misleading. The market could be experiencing higher highs and higher lows instead of a genuine false breakout. In such scenarios, it's essential to use other technical indicators, like candlestick patterns, to confirm the upthrust.

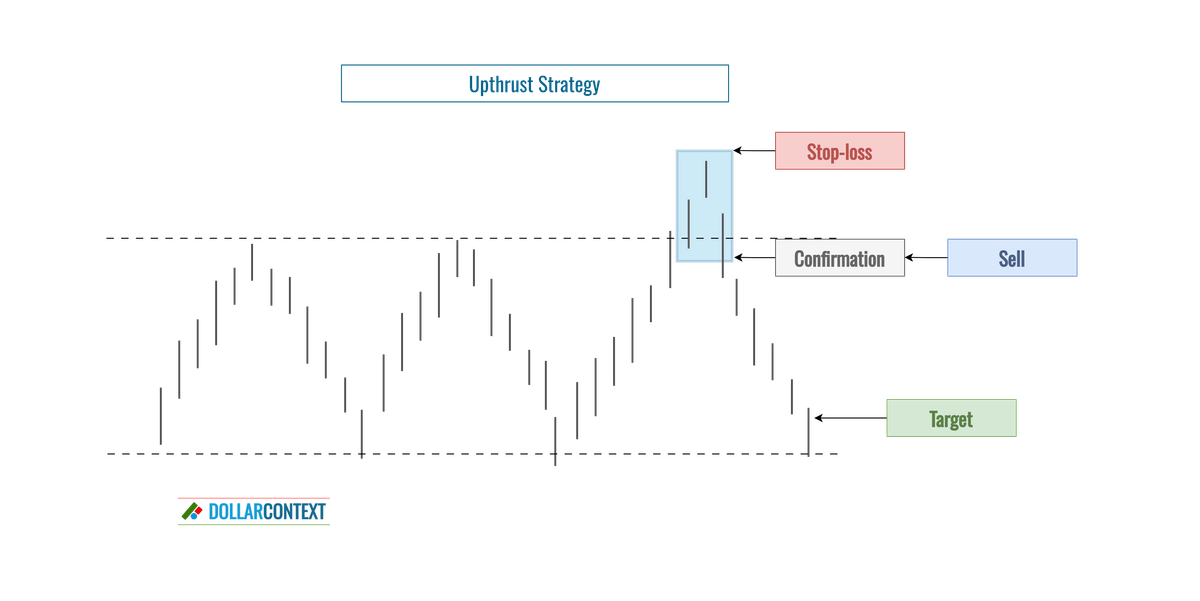

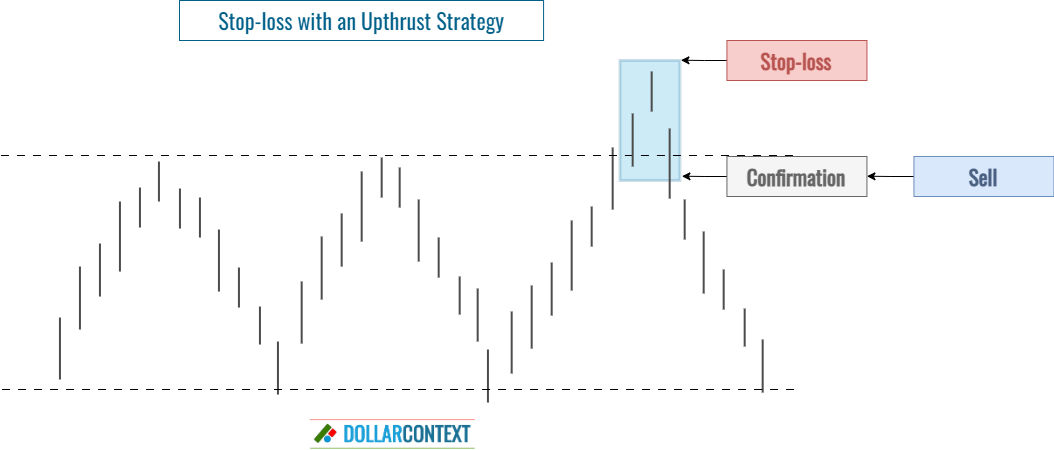

3. Setting Your Stop-loss

A key benefit of the upthrust strategy is that, when implemented correctly, it offers a straightforward protective stop: the new high made with the false breakout.

You might think about including a slight cushion to avoid being stopped due to market fluctuations.

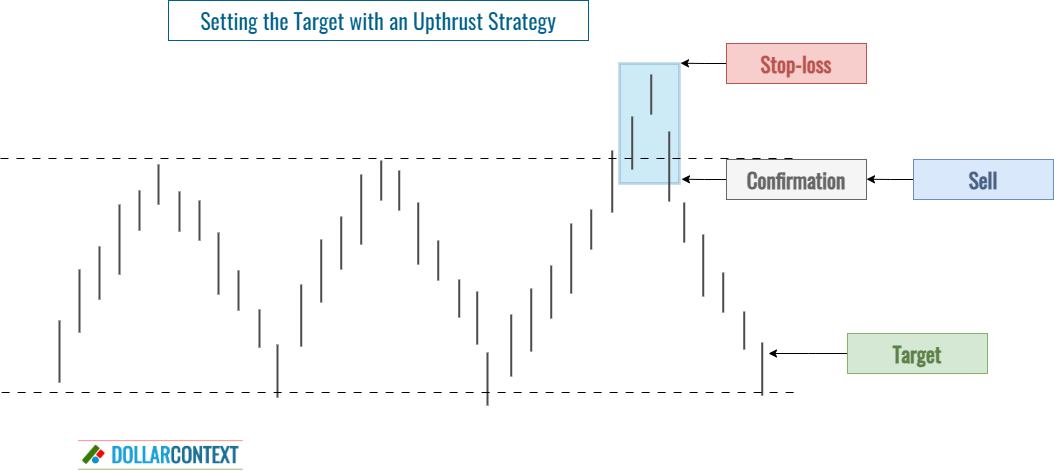

4. How to Set Your Target

If the upthrust occurs in the context of a lateral range, the target of your trade should be placed near the lower boundary of the range. Nevertheless, bear in mind that if you set the target too near the trading band's bottom, you might not reach it.

This chart shows how the dollar index displayed a sequence of upthrusts during a trading range in 2021 and 2022. Both of them reached the target at the range's base, with the second one breaking through to intensify the decline.

If the upthrust emerges in reference to a previously defined resistance area, the first target could be the next support level below the one where the upthrust began. Alternatively, you can use other technical indicators, such as Fibonacci retracements or moving averages, to determine the objective of your trade.

5. Conclusion

When the market is range-bound, upthrusts can serve as a powerful trading tool. They offer a distinct target (the other end of the trading range) and a protective stop (the new peak achieved during the "false breakout.")

Outside of a sideways market movement, upthrusts remain highly beneficial. In this case, however, you may need supplementary tools for pattern validation and target setting.